Sage Intacct’s third release of the year is here!

The automatic update hit your screens on Friday 9th August 2024, with even more new features and updates!

You may have already seen the announcement on your Sage Intacct homepage, these are our top highlights!

Note: There are new functions in this release which require action to update user/role permissions. You can read more about them here.

- As requested by you, you can now un-apply credits more easily

Unapply credits from Posted payments, when the credits are applied without an associated payment.

You can now unapply credits of all types, including the following:

- Advances

- Debit memo adjustments (supplier credits)

- Negative AP purchase invoices

- Negative line items applied from one AP purchase invoice to another AP purchase invoice

After you unapply a credit, the credit is available to apply to other AP purchase invoices.

To Unapply credits quickly:

Credit entries, which previously did not appear in Posted payments, now show as a separate line item with an amount of 0. An Unapply link appears next to credit entries only.

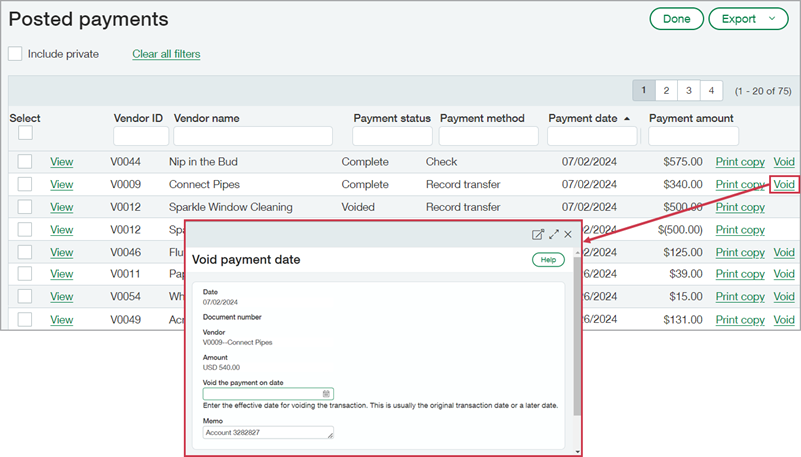

Selecting Unapply opens the Void payment date popup, where you provide the date when you are removing the credit. Where applicable, Sage Intacct also provides the option to reverse the AP purchase invoice.

How it works:

Unapply a credit applied without accompanying payment

- Go to Accounts Payable > All > Payments > Posted payments.

- Select Unapply next to the credit.

- In Void the payment on date, enter the date when you want to remove the credit.

- Optionally, enter a Memo to describe the reason.

All credits applied in this entry are now removed from the AP purchase invoice and are available to apply to other AP purchase invoices. If the credit was created in error, you can now reverse it.

Unapply a credit applied at the same time as a payment

To remove a credit that you applied alongside a payment, you need to void the payment.

- Go to Accounts Payable > All > Payments > Posted payments.

- Select Void next to the payment that includes the credit.

- Enter a Void the payment on date.

- Optionally, enter a Memo to describe the reason.

Sage Intacct voids the payment and unapplies the credits. You can now apply the credits to other AP purchase invoices.

Reverse an applied credit

- Unapply the credit from Posted payments.

- Reverse the credit, provided it has not been applied to any other AP purchase invoices.

Where you reverse the credit depends on the type of credit.

- Debit memo adjustments: Reverse the credit from the AP Adjustments list.

- Negative AP purchase invoices: Reverse or delete the AP purchase invoice from the AP purchase invoices list.

- Advances: Void the prepaid advance from the AP Advances list.

- Review the credits applied to a payment

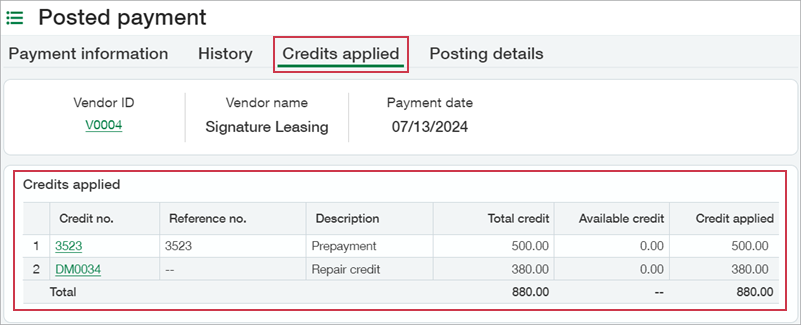

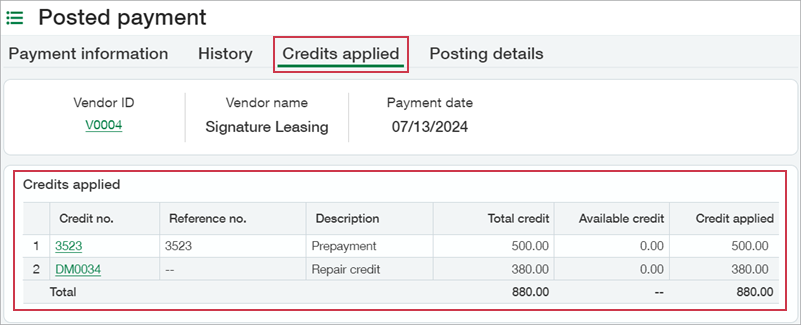

The Posted payment detail page now includes a new Credits applied tab that shows information about all credits included in a payment. Select the Credit no. to drill down further.

- Void payments directly from the posted payments page

Previously the method used to void payments depended on the payment method. That might of meant voiding a cheque payment from the bank or a credit card register report.

Now, you can conveniently void payments using the void link located on the posted payments page.

No Cash management permissions are required to void the payment.

- Easily Track Order Entry and Purchasing Transaction History

Purchasing and Order Entry workflows provide great flexibility with multiple potential transaction entry and exit points. Now you can easily track which transaction started a workflow. A more traceable workflow ensures greater inventory reconciliation accuracy.

- View real time data with the latest Usage Insights

Usage Insights allows full visibility across your company with pre-built metric dashboards to facilitate operational decision-making about your accounting processes.

Key areas covered include:

Overview tab

- Track active customer and vendor growth.

- Monitor Intacct subscription module activations and user activity, such as login.

- View the number of locations associated with your entities.

Customers tab

- Analyse customer growth trends.

- Visualize customer locations on a map for better geographical understanding.

Suppliers tab

- Analyse supplier growth.

- Visualize supplier locations on a map.

- Track Accounts Payable AP purchase invoices over time.

API usage tab

- The API usage information has been moved to a tab in Usage insights.

- API usage includes API transactions originating from Web Services and AJAX calls for the current month and the previous 3 months. These transactions can be made by your company’s custom integrations, partner integrations, or by Sage Intacct applications.

- Important TAX changes when reporting on input and output taxes

Previously, when you used Sage Intacct to prepare your tax submission, Sage Regulatory Reporting ignored the output values and used the input values to report both input and output taxes.

Due to recent changes to support reverse charge and partial exemption, Sage Regulatory Reporting now accepts and calculates for both input and output values. This means that when you post a reverse charge, instead of only using input tax details, you must now use input and output tax details so that the taxes are reported to the correct boxes.

You can do this by using the Multiple taxes on line checkbox and entering the input and output tax details and amounts on separate lines.

This updated workflow affects all reverse charge transactions.

Refresh your standard tax setups with the available updates on the Tax Solutions page.

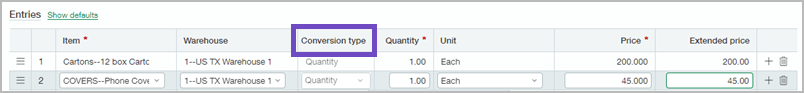

- Setup blanket sales orders as recurring transactions

The sales order workflow now allows you to easily keep track of the remaining balance in recurring scheduled sales order transactions.

If your Order Entry application is configured to allow conversion by price, you can now view the default conversion type in your recurring transaction templates. This increased flexibility helps you keep track of remaining contracted quantity or price on recurring Order Entry transactions.

- AP purchase invoice Automation is now available

AP purchase invoice Automation has now entered general availability!

AP Automation, an add-on feature to Accounts Payable, streamlines your data entry process to save you time and money. Intacct automatically creates draft AP purchase invoices from AP purchase invoice documents that you email or upload to Sage Intacct. AP purchase invoice details are automatically populated for you, using data from the original document and the supplier information record.

Additional features to be aware of:

- Save time when you create journal entries from bank transactions during reconciliation. The exchange rate date defaults to the bank transaction date for improved accuracy.

- Streamlined screens to apply permissions and roles when you add a new user. This is now consolidated onto a single page.

- 3 new reports to the Fixed Assets Management reports package: Fixed Assets Net Book Value, Fixed Assets by Employee and Fixed Assets by Location

- Barcode fonts now available for printed document templates: Two Google barcode fonts are now available for use in printed document templates.

Coming Soon!

Sage also have some exciting new features currently in their Early Adoption phases including:

Automated transaction matching in all regions—Early adopter

Streamline your Purchasing workflow by letting Sage Intacct create draft transactions from incoming PO purchase invoices and match them to existing purchase transactions. This Early Adopter Program is now available in all regions.

No more spoilers!

The above are a few of our favourite changes in the latest release. More details can be found on all of these plus more when you login to your Sage Intacct homepage. Alternatively, click here

Should you want to discuss any of the changes or have any question please feel free to send us a message at customersuccess@acuitys24.com or call us on 01932 237110.

Go to our resources library

See our new Sage Intacct content and free training videos, so you can get the most from your solution.