Sage Intacct’s last release of 2025 is here!

The automatic update hit your screens today, November 7th 2025, with even more new features and updates to make the most of! You may have seen the announcement on your Sage Intacct homepage, these are our top highlights!

*Note: Some permissions have been added and changed to support the new features. New Permissions are automatically “OFF” by default and will need switching “ON” by you to use the features. New Permissions include: AP/AP Purchase Invoices – List, View, Edit. AP Automated Transactions – List. Purchasing Transactions – View, Edit, Add, Delete, Override Exceptions. AP Ledger Report – Run. AR/Print or Email Statements – Run. CM Bank transaction Rules – Add, Edit, List. T&E Employees – List, View Edit. FA Asset – List, View, Edit. GL General Ledger Report – Run.

Our Top 13 Higlights of Sage Intacct R4 2025

1. Sage AI – Close Automation

Close Workspace empowers finance teams to execute their close with greater confidence and efficiency.

Find out how to Streamline workflows, enhance visibility, and reduce delays in your financial close process, by joining our learning lab on 4th December – Register Here.

2. Smarter enhancements to AP and Purchasing Automation

New features added to the enhanced email domain, means smarter email capabilities in the automation workflow such as:

· Auto-forwarding rules: Save time with auto-forwarding rules, so you do not have to forward each email to your automation email manually.

· Email copy capabilities for bounce back notifications: Get notified when automated transaction documents bounce back to the original sender. This helps you stay on top of incoming transactions and proactively communicate with vendors when documents do not get processed.

· New file formats:

o Attachments that are in the email body can now be extracted for processing.

o Transactions can now be read even when they’re in the email body as text, not just when added as an attachment.

o iPhone images in the HEIC file format are now supported. Configuration changes are required – please get in touch or see here for further details: Smarter email capabilities for AP Automation

3. Further flexibility to the AP Ledger Report

Utilise more filtering options, helping you to refine you report and target specific data, saving you time spent preparing reports and cleaning up data relevant to your specific requirements.

Key filtering benefits include:

· Run the AP Ledger report for multiple suppliers at once

· Select individual suppliers or specify a group of suppliers with identifying criteria such as geography, industry, payment terms etc. For information on how to setup please get in touch with us or see More filter options in the AP Ledger report

4. Automatically assign payment ID’s to AP advances

Intacct can now generate unique payment ID’s for AP advances, helping you easily find and reference AP advances in lists and reports.

Intacct will display the payment ID in views and on the posted advance detail page, meaning identifying and matching the payment will be more efficient during the bank reconciliations.

The following reports will also display the payment ID:

· Cheque Register and AP Ledger – Payment ID will be displayed in the Document No. Column

· AP Aging Report – Payment ID will be displayed in the Invoice Column Please see here for the Configuration changes require Add auto-generated payment IDs to AP advances

5. Broader visibility with match tolerance on purchase orders

You can now accurately track mismatches such as transaction value or percentage differences on purchase orders by using the exception summary when match tolerance is enabled.

Use the match tolerance Exception summary to:

· Easily identify the exact quantity and/or price differences between workflow transactions.

· Quickly recognise specific transaction details to make sure payments line up with approved purchase quantities and amounts.

· Provide Accounts Payable or other departments in charge of finances clearer reports on company spending. Please see here for the Configuration changes required and further information Broader visibility into match tolerance exceptions

6. Further transaction analysis when running customer statements

Further filtering options allow you to select which transactions you want included in your customer statements. When running an open item customer statements, the new transaction options will provide more granularity and insight into which transactions will appear in the statement.

The updated transaction options include the following:

· Show all transactions

· Show open invoices and credits

· Show open invoices Please see more here New transaction options when running customer statements

7. Easier reconciliations with debit and credit combinations.

You can now combine debit and credit transactions for reconciliation matching. The process is now automated with the new reconciliation rules reducing the need for manual matching. To configure and switch on this feature, please see here Combine debit and credit transaction amounts for easier matching

8. Fixed Asset Accounting Updates

In this release there has been a variety of updates to the Sage fixed asset module, these include:

· Ability to partially dispose of assets, leaving the existing part of the asset to continue depreciating

· Functionality to create multiple Assets from AP and AR Invoice lines

· Option to skip asset creation from AP and AR invoice lines when not needed.

· Asset Edits

o You can now edit dimensions directly on assets in service without performing a transfer or generating journal entries

o Previously, you couldn’t rename assets that were in service or created from bills or purchasing transactions. Now, you can edit the name of any asset in the Ready for review or In service states.

o Now, you can easily switch between System calculated and Manual entry Depreciation at any time, even if assets already exist in your company. For more information on the fixed asset changes please see here: Other updates to Fixed Assets Management

9. Save time by creating timesheets with default values

Reduce errors and save time by setting default values on employee records so that they automatically appear on timesheets when using Sage Intelligent Time.

Set default values for each employee to ensure consistent and accurate data entry and reporting. This helps enter data quickly and reduces manual errors.

It is worth noting that when an employee creates a timesheet, default values populate automatically based on their employee record. If a project is selected, the timesheet will instead use the project’s default values, which override the employee defaults.

10. Automatically validate timesheets using Sage Intelligent Time

Previously validating timesheets would require the timesheet to be submitted first. However from this release timesheets are validated automatically, even when in draft status, ensuring that all components of a timesheet are correct before submission reducing any delays.

Sage Intelligent Time validates timesheets by completing the following:

· Ensures all dimensions selected in a timesheet are valid and accessible to an employee based on their permissions

· Restricts access to unauthorised dimensions

· Provides clear error messages with guidance to resolve validation issues

11. General Ledger report updates to include unposted journal entries.

Get transparent and real-time views of your financial data by including unposted journal entries in the following reports:

· General Ledger report

· Journals report

This updates provides you with improved financial visibility earlier in the process by showing the impact of draft, submitted, or partially approved journal entries before they’re posted.

This feature applies to journal entries only. Unposted subledger transactions are not included.

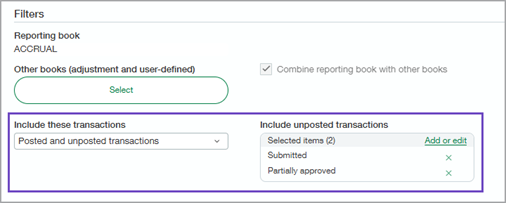

The Filters section of supported reports shows an Include these transactions dropdown list. The following options are available and will vary is you have journal approvals enabled:

· Posted transactions only

· Unposted transactions only

· Posted and unposted transactions

12. Term discounts for taxes

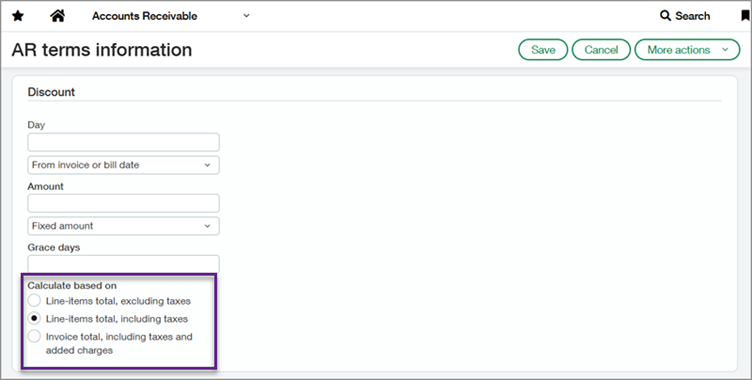

Customers using a standard or custom tax solution in the Taxes application can capture taxes on term discounts in their Accounts Receivable and Order Entry transactions.

You can create new terms or modify existing terms with a new calculation method for the discount.

Requirements for applying term discounts and calculating taxes on those discounts can vary between regions. Now, you can set the calculation method for your Accounts Receivable and Order Entry terms to meet the requirements of your operating country. Further information and configuration details can be found here: Support for term discounts for taxes—General availability

13. Sage learning updates

New training courses and videos have been added to the Sage University and video library.

Sage have also released a new format of the Sage Intacct fundamentals course, where this is now split into 5 separate courses, allowing you the flexibility to complete the topics that best apply to your role. Details of all new videos added can be found here: New training and videos

COMING SOON

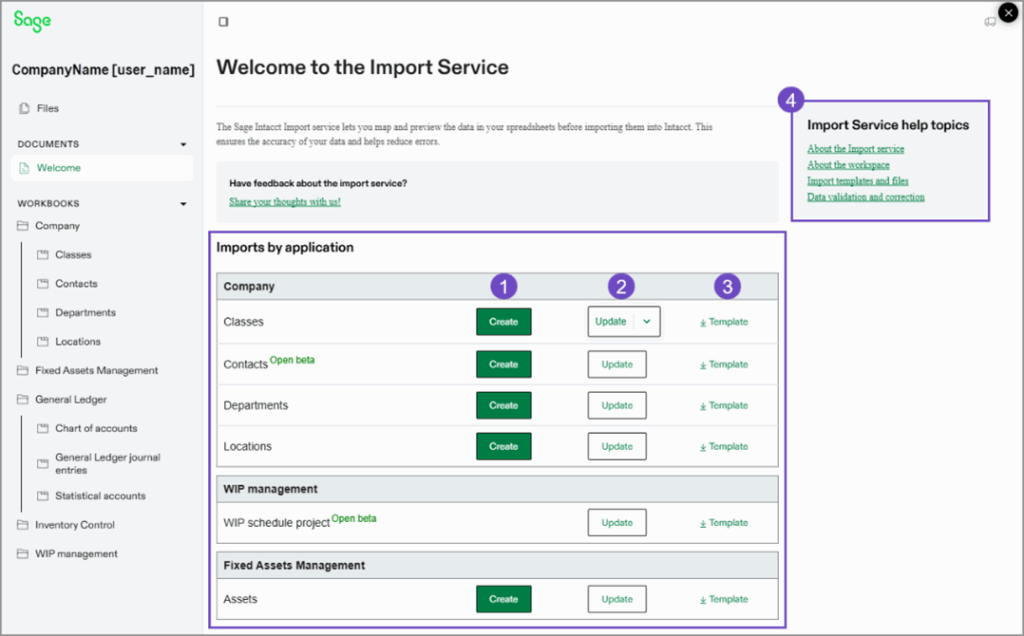

Updates to the Sage Intacct import service – Limited Beta Access

The Sage Intacct import service provides a structured, user-friendly workflow for importing data into Intacct. You can preview, validate, and correct data in the import service before finalising the import, ensuring accuracy and reducing errors.

More information can be found here, with details on how to get signed up for Beta Access to the new import feature: Updates to the Sage Intacct import service

No more spoilers!

The above are a few of our favourite changes in the latest release. More details can be found on all of these plus more when you login to your Sage Intacct homepage, Alternatively, you can find further information by joining us at our Learning lab on Thursday 20th November @12pm, Register Here Or Click Here to read more about Release 4 2025

Should you want to discuss any of the changes or have any question please feel free to send us a message at customersuccess@acuitysolutions.co.uk or call us on 01932 237110.