Sage Intacct’s First release of the year is here!

The latest update hit your screens on February 7th 2025 with even more new features and updates to make the most of!

You may have already seen the announcement on your Sage Intacct homepage, where you can read more, in addition to our highlights below.

Action Required!

Before we get in to the highlights, there are a few things to be aware of that may require action:

1. Authenticate and validate your custom domain before May 2025

All customers who send emails using a custom domain must authenticate and validate their domain. This is a critical step as Sage transition fully to using the enhanced email delivery service.

Authenticating your domain helps ensure your email communications are secure and reliable. Domain authentication:

- Improves email deliverability, reducing the chances of your messages being marked as spam or not reaching recipients.

- Protects your domain from being used in phishing attacks or other fraudulent activities.

- Aligns with best practices for email security and compliance.

Configuring these settings will require input from both your Intacct and email administrator. Find the steps you will need to take here

2. Permissions

Some permissions have been added and changed to support the new features. New Permissions are automatically “OFF” by default and will need switching “ON” by you to use the features. New Permissions include changes in the below with full details outlined here:

- AP – Enable and create Deferred adjustments and templates and run the deferred adjustments forecast report

- AR – Enable and create Deferred adjustments and templates and run the deferred adjustments forecast report

- GL – Variance analysis for Sage Copilot and GL regularisation account reclassification report

- OE – Revenue transaction entries to recognise external revenue and the associated bult actions

Our 2025 R1 Release Highlights:

You may have seen the announcement on your Sage Intacct homepage, these are our top highlights!

- AP Automation with Purchasing

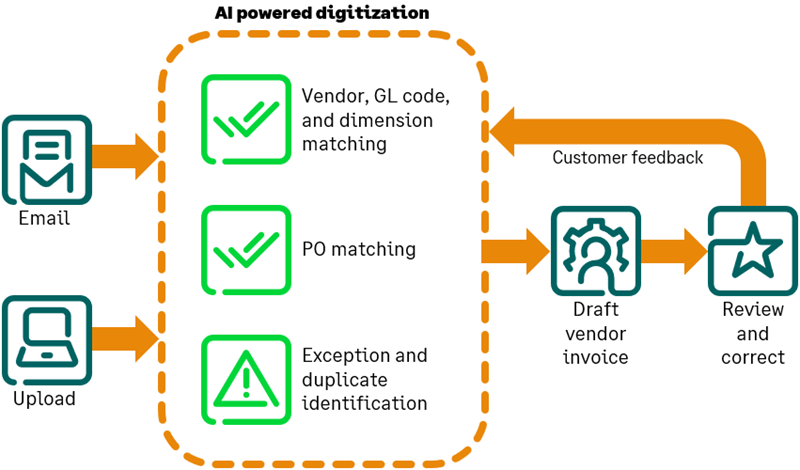

This idea came from you! An addition to the AP Automation feature released in 2024, you can now Streamline the process of drafting and matching incoming purchasing transactions with Purchasing automation. AP Automation with Purchasing drafts the incoming PO purchase invoice and matches it to any previous documents, such as the purchase order or receiver.

Details

- Instead of converting Purchasing transactions to PO purchase invoices, you let Sage Intacct match incoming PO purchase invoices, using the following flow:

- You email or upload PO purchase invoice documents for automated processing.

- Sage Intacct uses artificial intelligence (AI) to detect the supplier and match the PO purchase invoice to a Purchasing transaction.

- The system creates a draft PO purchase invoice for you, with the source document attached. Line items populate based on the matched source transaction.

- You review the draft PO purchase invoice, validating it against the source document and making corrections as necessary, and then post.

- Your corrections are fed back to the AI engine, where it updates the machine learning model to improve future matches.

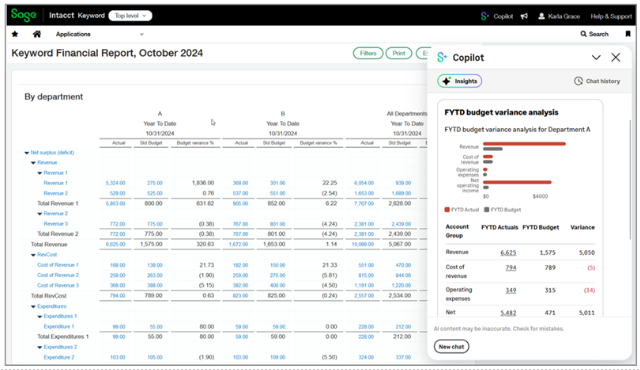

- Copilot Variance Analysis—Phased release for UK

Copilot Variance Analysis has started a phase release for customers in the UK. Copilot Variance Analysis provides insights into budget or prior period differences so business leaders can proactively investigate discrepancies and address spending concerns. Copilot notifications are designed to keep budget owners in the loop, whether it’s a timely update or an on-demand review. You can drill into report insights to see exactly how your budget is doing, including detailed breakdowns and visualisations.

- Extended Approval Flexibility

This release include updates to both AP and Purchasing approvals.

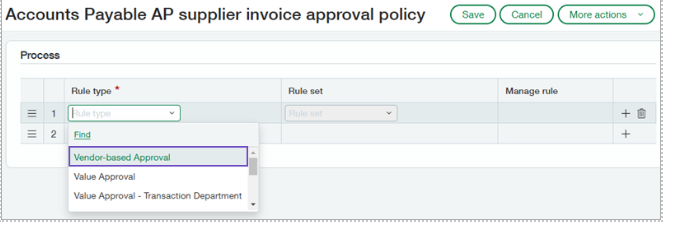

- Introducing supplier-based approval for AP purchase invoice

Does your organisation assign approval responsibilities for AP purchase invoices based on the supplier? If so, you’re going to love the new supplier-based approval rule type for AP purchase invoice approval policies.

When you add the supplier-based approval rule type to your AP purchase invoice approval policy, you now have the option to assign an AP purchase invoice approver to each supplier, in the supplier record. Then, when an AP purchase invoice is submitted, Sage Intacct routes the AP purchase invoice to the assigned approver’s queue for review.

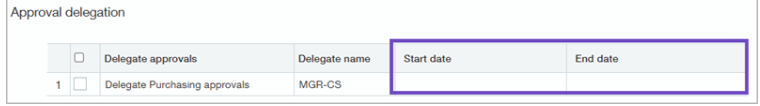

- More flexible purchasing approval delegation with the ability to assign delegation to restricted users and set your out of office for a specific timeframe.

When you assign a delegate approver, users and user groups with the required permission levels are now available for selection. Previously, delegation couldn’t be given to users who were restricted to specific departments and locations, and delegation could only be assigned to individual users.

If you are the approver, you can now also reduce the risk of forgetting to turn your delegation out of office on or off by setting start and end dates in advance.

To check on approvals which occurred while you were away, you can generate a report on all the approvals occurring in your absence by adding the approver column to a custom report.

- Enhancements to Accounts Receivable Statements

Last release, running balances and currency symbols were introduced to statements. This time, functionality has been extended to include the ability to add header level custom fields in templates and streamline processing for large statement runs.

- Custom field support

Custom AR statement templates now support custom fields for the following objects:

- Customer – Custom fields are supported in the statement header.

- Invoice – Header-level custom fields for AR sales invoices are supported in the statement’s PRENTRY table

- AR Adjustment – Header-level custom fields for AR adjustments are supported in the statement’s PRENTRY table.

When editing Printed document template, be sure to download and save a copy of the custom template first. Once updated preview the statement for any customer to verify that the running balance looks as you expect. If necessary, edit the Word document, upload it again, and re-test.

- Increased capacity for large AR statement runs

Don’t get caught up waiting for a large statement batch to run. Now, when you select many statements to print or email, Sage Intacct processes the statements through the job queue. This means you can move on to the next job activity without delay. For printed statements, you can then return to print the PDF when it’s convenient for you.

- Dimension distribution in subtotal lines

Eliminate the need for manual entry on subtotal lines with the new dimensional distribution feature in Order Entry and Purchasing . Dimension details can now automatically be carried over to subtotal lines for your entity-level transactions.

Configuring this ensures that each line item’s distributions display on the Transaction details page, and any required tax distributions display on the Posting details tab.

- Bank transaction assistant supports draft payments

For greater flexibility, you can now draft customer payments that you’re not ready to post using Bank transaction assistant.

You can also post draft payments in bulk from the Posted payments page in Accounts Receivable. If you decide you no longer need a draft, you can simply delete it from the list.

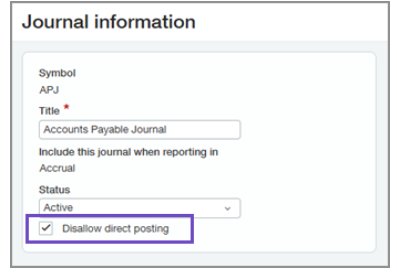

- Controls to Prevent direct posting to specified journals

Direct entries to General Ledger journals are one of the primary causes of discrepancies between subledgers and the General Ledger. You can prevent these entries on a journal-by-journal basis by enabling the ‘Disallow Direct Posting’ on the journal set up page. This option prevents users creating entries for the journal through the Journal entries page in General Ledger. Instead, users must post through the subledgers. This setting also prevents the creation of journal entries through an import or the API.

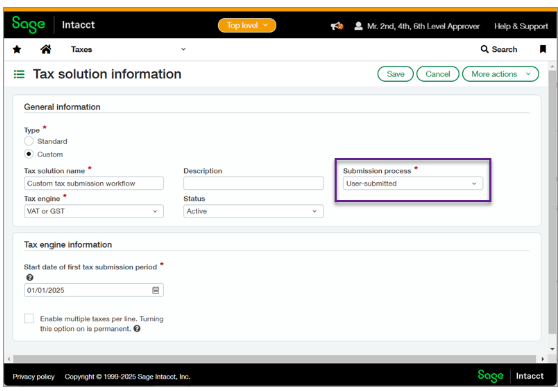

- Tax submission for custom tax solutions

The new tax submission workflow streamlines the tax filing process for any company using a custom tax solution.

Within the tax solution you can now set the submission process for that tax solution as User-submitted. This lets you record tax submissions for any company or entity that uses a custom tax solution. When you create a tax submission, Sage Intacct locks transactions that are included in the tax submission period. You can run reports on the tax records for those transactions to extract the data you need to file your taxes. After you complete your manual tax filing, you can mark the submitted transactions as filed.

- Easily transfer assets between dimensions within an entity

The latest update to fixed asset management enables the ability to easily transfer assets between departments, projects, or other dimensions.

Each transfer automatically generates journal entries to update the asset’s dimensions in the General Ledger, removing the need for manual updates. Transfers are also recorded on the new Transfer History tab for complete transparency and tracking.

This streamlined process saves time and effort while ensuring accurate records and clear visibility into ownership changes during the asset’s lifecycle.

- Enhancements to Receiving payments

The current way to receive a payment is retiring!

Since 2020, the payment receipt process has been enhanced to boost your efficiency. Many of you have already switched to the newer Receive Payments menu option and are enjoying its benefits. However, some are still using the older Receive a Payment method.

This is a reminder that the older payment receipts method will be retired in May 2025 (Release 2). If you have not made the switch yet, now is the time to do so. Transitioning to the new method will allow you to take full advantage of the latest features.

Coming Soon!

With this release Sage have announced lots of exciting new features currently in the Early Adopter phases. You can read more about these and how to get involved in the release notes.

As an early adopter, you can influence how we develop the product so that our product meets your business needs. The Early adopter program participants work closely with Sage Intacct product managers to ensure we focus on what matters most. Early adopter participants are expected to periodically respond to surveys and provide input.

Some of these programmes include:

Support for term discounts for taxes—Early adopter

Customers using a standard or custom tax solution in the Taxes application will be able to capture taxes on term discounts in their Accounts Receivable and Order Entry transactions.

Users will be able to create new terms or modify existing terms with a new calculation method for the discount.

Create customised tax reports—Early adopter

You will no longer need to calculate your VAT or GST tax returns outside of Sage Intacct to get insight into your upcoming tax burden. With the new tax report feature, you will be able to define tax report boxes, add those defined boxes to a tax report template, and run a tax report from that template. This lets you calculate your tax burden for a defined period so you know what to expect before you start your tax submission. Or you can select a standard or custom tax solution and run a tax report on an existing tax submission.

Enhanced currency support for funds transfers—Early adopter

Enabling global companies to process funds transfers with up to 3 unique currencies without having to create a manual journal entry.

The streamlined process will create a funds transfer and made it easy to work with 3 currencies.

- When creating a funds transfer, just enter the amount sent and the amount received; you do not need to add an exchange rate.

- Based on what you enter, we select the most accurate exchange rate.

- When required, we automatically create a rounding entry to account for any exchange rate differences.

Standalone PO purchase invoices will be supported by AP Automation with Purchasing—Early adopter

AP Automation with Purchasing now supports automated standalone PO purchase invoices as an Early adopter program. Previously, you could only configure automated transactions that match to existing documents, for example PO purchase invoices and the corresponding purchase orders. Now you can configure transaction definitions to create automated transactions without an existing source transaction to match.

Find Out More!

The above are a few of our favourite changes in the latest release. More details can be found on all of these plus more when you login to your Sage Intacct homepage, Alternatively, you can find further information by joining us at our Learning lab on Thursday 20th February @12pm, Register Here or Click Here to read more about Release 1 2025.

Should you want to discuss any of the changes or have any question please feel free to send us a message at customersuccess@acuitys24.com or call us on 01932 237110.

Go to our resources library

See our new Sage Intacct content and free training videos, so you can get the most from your solution.