Sage Intacct’s Latest release of 2025 is here!

The second automatic update of the year hit your screens on May 9th, 2025 with even more new features and updates to make the most of!

You may have already seen the announcement on your Sage Intacct homepage, where you can read more, in addition to our highlights below.

Note: Some permissions have been added and changed to support the new features. New Permissions are automatically “OFF” by default and will need switching “ON” by you to use the features.

New Permissions include:

- Accounts Payable

Adjustments: Add, Post

Previously, only the Adjustments Add permission was required to import posted AP adjustments using CSV import. Now, the Adjustments Add and Post permissions are required.

- Accounts Receivable

AR sales invoices: Add, Post

Previously, only the AR sales invoices Add permission was required to import posted AR sales invoices using CSV import. Now, the AR sales invoices Add and Post permissions are required.

Adjustments: Add, Post

Previously, only the Adjustments Add permission was required to import posted AR adjustments using CSV import. Now, the Adjustments Add and Post permissions are required.

- Projects, Time, and Expenses

Previously, Time and Expenses were a single application. Now, they are 2 separate applications that each have their own set of permissions. The separation has also impacted the Projects permissions, with some permissions moved to either the Time or Expenses permissions.

Projects and Time – My timesheets: List, View, Add, Edit, Delete

Previously, these permissions affected both the Projects and Time applications. Now, these permissions affect the Time application only.

Staff timesheets: List, View, Add, Edit, Delete

Previously, these permissions affected both the Projects and Time applications. Now, these permissions affect the Time application only.

Our 2025 R2 Release Highlights:

You may have seen the announcement on your Sage Intacct homepage, these are our top highlights!

1. ***Authenticate and validate your custom email domain during May 2025***

Starting May 2025, ALL customers who send emails using a custom domain must authenticate and validate their domain with the enhanced email delivery service.

This is a non-negotiable requirement as we transition fully to the enhanced email delivery service. For further details on authenticating your emails, please see here.

2. Enhanced data import, to make your data imports simple

Importing data is a critical function for accountants and partners, and Sage are making it easier than ever with the new import service. Instead of sending your data into a “black box” and waiting for error reports via email, you now have a dedicated import workspace that provides real-time visibility and control for the following imports: Vendors for Accounts Payable, Customers for Accounts Receivable, Classes, Departments, and Locations for Company, Chart of Accounts and Statistical Accounts for General Ledger, and Assets for Fixed Asset Management.

Please read here: Sage Intacct import service—General availability

3. Enhanced control for voiding reconciled transactions

This idea came from you!

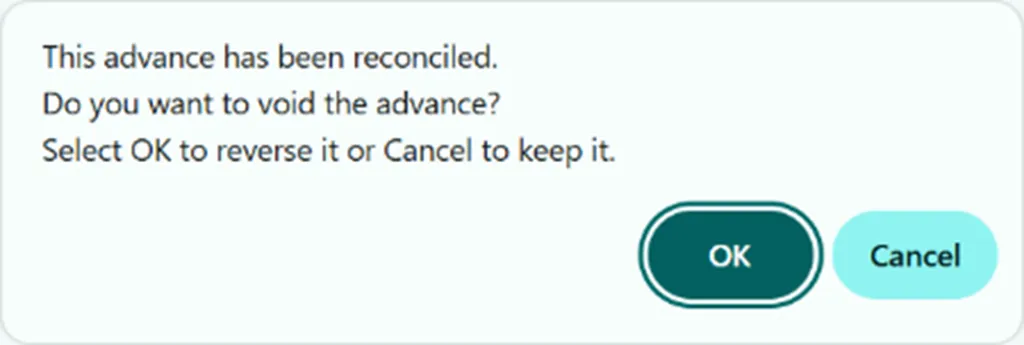

A new warning has been introduced to give you further control over voiding payments, helping you to avoid unintended changes.

When you try to void a reconciled payment, manual payment, or AP advance, Sage Intacct notifies you that the transaction has already been reconciled. The notification allows you to make an informed decision on whether to proceed or cancel the operation.

This alert helps you maintain the integrity of your reconciled periods while giving you the flexibility to manage your transactions effectively.

This release does not change the rules of what you can and cannot void in a reconciled period. Only the warning message is new. To see how this works, visit – New warning when voiding a reconciled transaction.

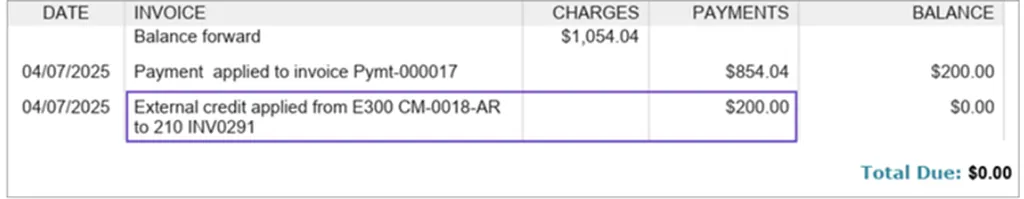

4. External credits included in entity-level AR Statements

Previously, all external credits applied to transactions in the entity showed in the reports but only advances and overpayments showed in AR statements run at the entity level.

You can now align entity-level AR statement balances with your AR Ledger and AR Aging reports by showing credits that you applied from other entities.

When you select “show external credits” in AR statement filters, Sage Intacct includes any adjustments and negative AR sales invoices owned by other entities that were applied during the selected period.

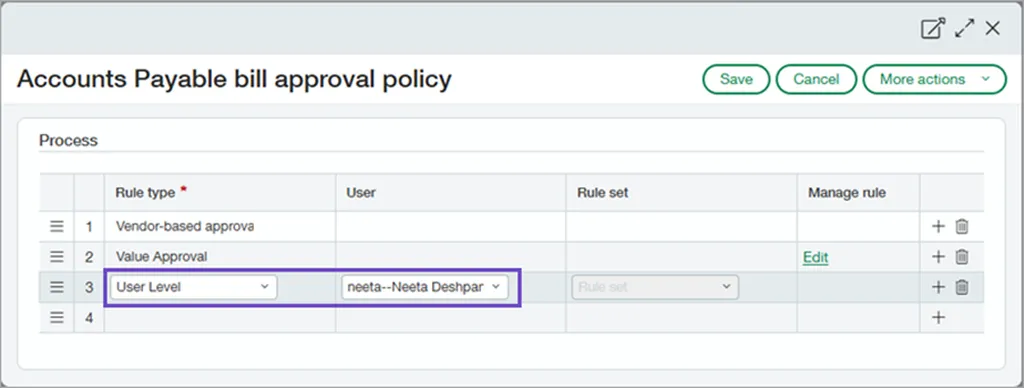

5. Use User Types instead of users for AP Approvals

Sage have updated the way you add approval users to your AP purchase invoice approval policy to remove clutter from the Rule type list and make the approval policy easier to scan.

The Rule type column, which previously included rule types and users with AP purchase invoice approval permissions, now contains only rule types. To add a named user, select the new User Level rule type. Then, in the new User level column, select an approver from the list of users with AP purchase invoice approval permissions.

Already have named users as part of your AP purchase invoice approval policy? You’re all set! Sage Intacct automatically converts your named users to User Level rule types.

6. Inter-Entity AP Purchase bill back now support child locations

Inter-entity bill back now supports child locations of an entity, allowing you to create bill back AR sales invoices with more detailed location coding.

When creating an AR sales invoice using a bill back template, you can select a child location in the line items. Sage Intacct refers to the parent entity to find the associated supplier.

A corresponding AP purchase invoice is created in Accounts Payable for the supplier associated with the parent entity.

A few things to note for this update:

- All line item locations in an AR sales invoice must share the same parent entity when an AP purchase invoice back template is applied.

- The AP purchase invoice created in Accounts Payable shows the entity as the location, rather than the child location.

- As long as an entity record specifies an associated supplier, you can use that entity’s child locations for line items on AR sales invoices with bill back templates.

No additional setup is required to use child locations on AR sales invoices if you’re already set up for inter-entity bill back.

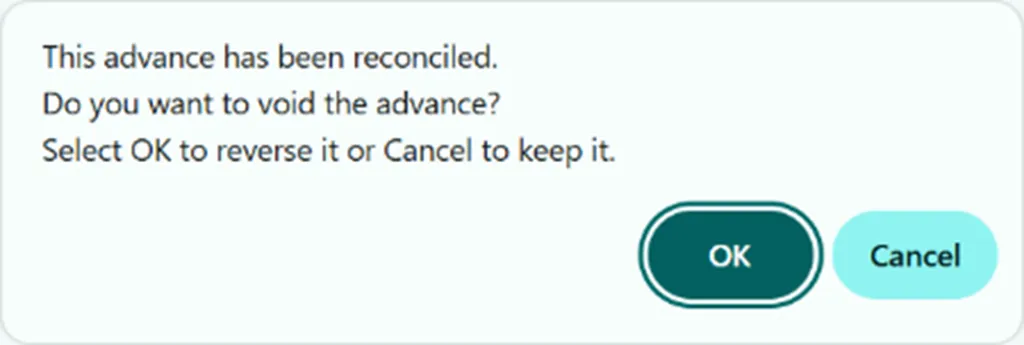

7. Enhanced controls when reversing a reconciled AR advance

This idea came from you!

There is also a new warning feature to enhance your control over reversing advances and help you avoid unintended changes to your reconciled periods.

When you try to reverse a customer advance, Sage Intacct notifies you that the transaction has already been reconciled. The notification allows you to make an informed decision on whether to proceed or cancel the operation.

To see how this works, visit – New warning when reversing a reconciled advance

8. Speed up your credit card reconciliations with the new credit card bank transaction assistance file import

Import credit card transactions for reconciliation. Control who imports bank transactions with a new permission and view a list of all import activity for added insight. Multiple file formats are supported, which gives you extra flexibility.

This import experience also works with Bank transaction assistant.

Details

Import CSV, QIF, XLS, XLSX, OFX, CAMT.053, BAI2, and ASO files. To ensure a smooth import process, make sure that your file is formatted correctly.

For CSV, XLS, and XLSX files, specify whether your file displays amounts in two columns (money in and money out) or one column (positive and negative amounts appear in this column). You select a 3 column or 4 column file type, respectively. There are also additional columns to add for even more insight into transactions.

9. Classic Import for reconciliation is retiring

Since 2024 Release 2, Sage have been enhancing the bank transaction import process to boost your efficiency. Many have already switched to the newer Bank transaction assistant file import experience and are enjoying its benefits. However, some are still using the older Classic import method.

This is an announcement that they plan to retire the Classic import method no earlier than May 2026. Keep an eye out for an update about the specific date in an upcoming release. If you have not made the switch yet, now is the time to do so. Transitioning to the new method will allow you to take full advantage of the latest features we offer.

This change does not impact any custom integrations that use the Intacct API. For further details please see – Classic import for reconciliation is retiring.

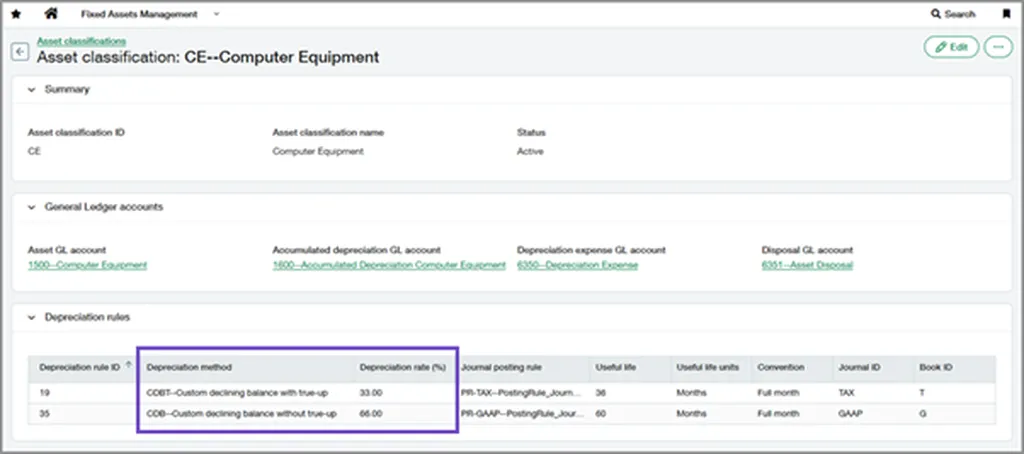

10. Manage your fixed assets with custom depreciation policies

Sage have added two new depreciation methods to help you comply with financial and tax regulations in Australia, Canada, South Africa, and the United Kingdom:

- Custom declining balance with true-up (CDBT)

- Custom declining balance without true-up (CDB)

These methods allow you to customise the depreciation rate applied to assets under a declining balance method, providing greater flexibility when managing your assets.

Details

- User-defined depreciation rate: When using a custom method, a new field called Depreciation rate is available on depreciation rules. You can select a rate from 1.00% to 100.00%.

- Calculation: In general, depreciation amounts are calculated using the following formula: (Asset cost − Salvage value − Accumulated depreciation) * Depreciation rate

- With true-up: For the custom declining balance with true-up method, the remaining depreciation is applied in full in the final period, instead of being multiplied by the depreciation rate. This ensures that the entire depreciable cost is trued up and accounted for in the schedule.

- Without true-up: For the custom declining balance without true-up method, the depreciation rate is applied throughout the asset’s entire useful life. Any remaining depreciation at the end of the asset’s life is treated as a loss upon disposal.

To find out how to set this up go to: Custom declining balance depreciation methods.

11. Post permissions required when importing non-draft AP posted adjustments and Non-draft AR sales invoices and adjustments

Users importing posted AP adjustments must have Adjustments: Add, Post permission. Users without Post permissions can import adjustments as drafts, as long as they have Add permissions. Users importing posted AR AR sales invoices must have AR sales invoices: Add, Post permissions. Users importing posted AR adjustments must have Adjustments: Add, Post permission. Users without Post permissions can import AR sales invoices and adjustments as drafts, as long as they have Add permissions.

Coming Soon!

Automated transactions streamlined for AP Automation with Purchasing—Early Adopter

Boost efficiency by combining AI-powered transactions with the flexibility of the Purchasing application. You can now automate transactions that do not have a source match defined, for example, PO purchase invoices that do not start with purchase requisitions or orders.

If you’d like to be considered for the Early Adopter programs for automated transactions without matching, sign up today.

Record customer refunds—Coming soon!

This idea came from you!

We’re excited to announce the ability to record customer refunds, coming soon to Accounts Receivable. Customer refunds streamline your refund management process, ensuring that the refunds that you initiate outside of Sage Intacct are accurately documented and the refunded credits are cleared. Eliminate the tedious step of creating balancing adjustments for refunded credits. Instead, record the amount refunded and pay available credits simply by selecting them.

Customer refunds offers the following benefits:

- Increased reporting accuracy: Up-to-date customer balances keep your financial reports on track.

- Tidier books: Close out credits easily and effectively, maintaining clean and organized financial records.

- Easily resolve inactive accounts: Efficiently refund and zero out accounts for customers who have credit balances with no planned future invoices.

- Refund audit trail: Provide a clear audit trail for all refunds, enhancing transparency and accountability.

Customer refunds is currently available as part of a limited Early Adopter program for selected customers only but we look forward to it coming to customer more widely over the coming releases.

No more spoilers!

The above are a few of our favourite changes in the latest release. More details can be found on all of these plus more when you login to your Sage Intacct homepage, Alternatively, you can find further information by joining us at our Learning lab on Thursday 22nd May @12pm, Register Here Registration or Click Here to read more about Release 2 2025.

Should you want to discuss any of the changes or have any question please feel free to send us a message at customersuccess@acuity24.com or call us on 01293 246080.