Introduction to Sage Intacct Reporting

Sage Intacct provides exceptional reporting capabilities and actionable insights into their operations. In this post we look at how Sage Intacct financial reporting features provide clarity, flexibility and customisation for empowered, data-driven decisions.

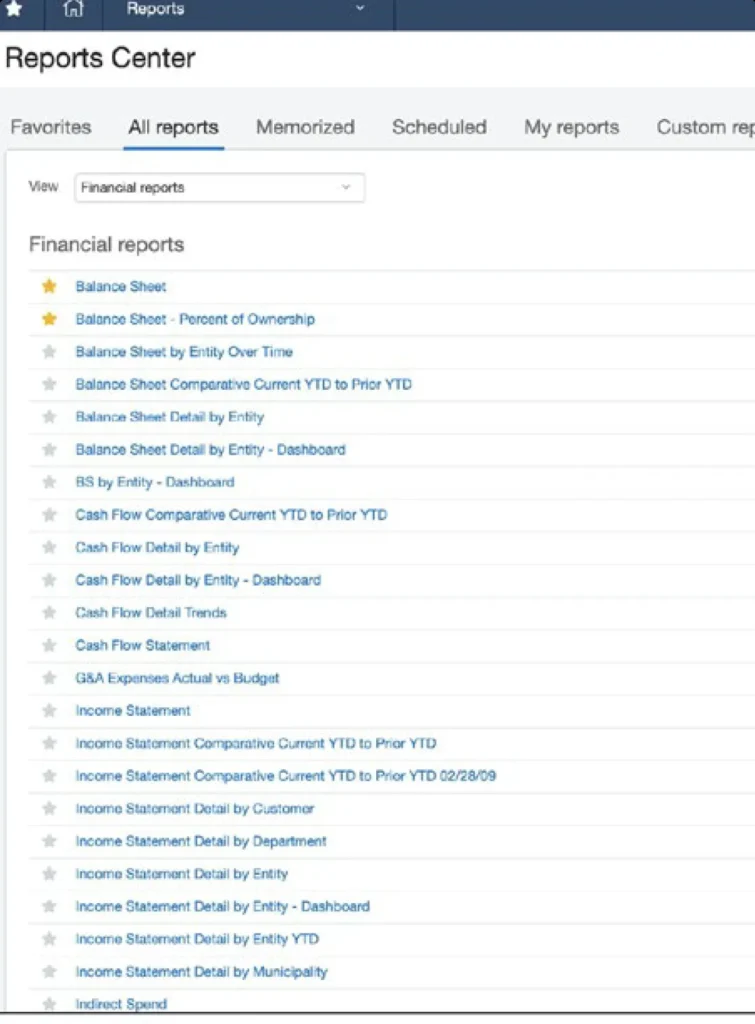

1. Financial Reports

At the core of Sage Intacct reporting, financial reports provide an essential, detailed overview of an organisation’s financial health, including:

- Income Statements (Profit & Loss Statements) highlighting revenue, expenses and net income over a specified period.

- Balance Sheets presenting an organisation’s assets, liabilities and equity.

- Cash Flow Statements tracking incoming and outgoing cash, providing visibility into liquidity and operational efficiencies.

- Budget vs Actual Reports for easy comparison of budgeted figures against actual perfomance, helping businesses stay in alignment with their financial goals.

Sage Intacct’s real-time data capabilities make these reports accurate and timely, ensuring decision-makers always have the most current insights available.

2. Operational Reports

Operational reports focused on day-to-day activities of the business allow teams to drill into specific areas including:

- Accounts Receivable and Accounts Payable Aging Reports to monitor outstanding invoices and payments due.

- Inventory Reports to track inventory levels, turnover and valuation.

- Employee Expense Reports to summarise employee-incurred expenses for better control and transparency.

These operational reports provide granular insights into the operational aspects of a business, helping teams optimise workflows and reduce inefficiencies.

3. Real-time Dashboards and Visual Reporting

Sage Intacct takes reporting to the next level with customisable dashboards that provide visual summaries of KPIs. These reports are especially useful for executives in need of a quick at-a-glance understanding of performance. Dashboards can include:

- Charts and Graphs for a visual representation of financial trends, such as revenue growth or expense patterns.

- KPIs and Metrics for real-time insights into metrics such as gross-margin, days-sales-outstanding, working capital and more.

Users can tailor these dashboards to suit their roles, ensuring every stakeholder gets the insights most relevant to their responsibilities.

4. Compliance and Audit Reports

For organisations who need to comply with regulatory standards, Sage Intacct offers specialised reports that streamline audits and ensure compliance. These include:

- Audit Trails that make it easy to track changes made to financial records aiding transparency.

- Tax Reports for simplified tax filing with detailed reports on taxable income and transactions.

- Regulatory Compliance Reports allowing you to generate reports meeting industry-specific standards.

These tools reduce the administrative burden of compliance, giving businesses peace of mind during audits.

Sage Intacct Overview

5. Sage Intacct Customisation Capabilities

Every organisation has unique reporting needs, made easier with Sage Intacct’s customisable report builder. Users can design reports tailored to their specific requirements, pulling in data across dimensions like location, department or product line. Features include:

- Drag and Drop Design Tools simplifying the report creation process.

- Filters and Sorting Options allowing you to refine data and focus on what matters most.

- Dynamic Insights with the ability to create reports that adapt to changes within the business.

This level of flexibility ensures your Sage Intacct financial reporting aligns perfectly with your strategic goals.

6. Consolidation Reports

Businesses with multiple entities or global operations benefit from the consolidation reporting Sage Intacct provides, enabling them to:

- Consolidate Financials Across Entities for a combined view of financial results in real-time.

- Handle Multi-Currency Reporting converting and reporting financials in different currencies.

- Segment Reporting for a breakdown of performance by entity, region or product.

These features are particularly beneficial for those operating in complex organisational structures.

7. Ad Hoc Reports

Sometimes, businesses need reports on the fly to help them react to unexpected trends and unforseen circumstances. Sage Intacct’s ad hoc reporting capabilities allow users to quickly generate reports based on immediate needs, without relying on pre-set templates.

Challenges in Traditional Reporting

Using Sage Intacct for reporting instead of relying on Excel and manual tasks offers several key benefits, especially for businesses that want to streamline their financial operations, reduce errors, and enhance decision-making. Here are the key benefits:

1. Real-Time, Accurate Financial Reporting

- Instant Updates: Sage Intacct allows for real-time reporting, so data is automatically updated as transactions are entered, ensuring that your reports are always current. In contrast, Excel requires manual input, and financial reports are often outdated by the time they’re generated.

- Reduced Errors: With Excel, there’s a higher risk of human error due to manual data entry and complex formulas. Sage Intacct reduces the likelihood of errors in your reports, providing more accurate insights.

- Consistency: Sage Intacct offers standardized reports, ensuring consistent reporting practices across the organization, while Excel reports may be prone to inconsistencies if different people are involved.

2. Streamlined Reporting and Automation

- Automated Financial Statements: Sage Intacct can automate the generation of key financial statements such as the balance sheet, income statement, and cash flow reports. This saves time compared to manually compiling data in Excel.

- Scheduled Reporting: You can set up reports to be automatically generated and distributed on a set schedule, eliminating the need for manual intervention.

- Eliminate Data Consolidation: Sage Intacct automates the process of consolidating financial data from different departments or business units, reducing the time spent on gathering and combining data manually.

3. Advanced Data Analysis and Insights

- Dashboards & Visual Analytics: Sage Intacct includes built-in dashboards and visual analytics, providing quick, interactive insights into your financial performance. These dashboards give you the ability to drill down into data with ease, something that can be cumbersome and time-consuming with Excel.

- Key Performance Indicators (KPIs): You can track KPIs with ease in Sage Intacct, whereas Excel requires manual setup and might not be as dynamic for real-time decision-making.

- Better Financial Forecasting: With Sage Intacct, you can run detailed reports and analyses that help improve forecasting accuracy. Excel-based models often need to be manually updated and may lack the advanced forecasting capabilities available in a cloud-based solution like Intacct.

4. Improved Efficiency and Time Savings

- Time-Saving Automation: Manual tasks like data entry, reconciliation, and report creation are automated in Sage Intacct, freeing up time for finance teams to focus on strategic tasks such as analysis and planning. In Excel, these tasks require a significant amount of time and effort, especially as data volume increases.

- Faster Close Process: Sage Intacct accelerates the month-end close process by automating key functions, while Excel typically requires more time for data entry, reconciliation, and report preparation, potentially leading to delays in financial reporting.

Book a Call or 1-2-1 Demo

5. Scalability for Growing Businesses

- Scalable Reporting Capabilities: As your business grows, Sage Intacct can handle increasingly complex financial reporting needs, including multi-currency, multi-entity, and multi-dimensional reporting. Excel becomes more difficult to manage as data volume and complexity grow, making it harder to maintain accurate and efficient reporting.

- Customisable Reports: Sage Intacct offers more flexibility in designing reports tailored to your needs. You can create custom reports based on specific dimensions (e.g., departments, projects, or regions), something that would be cumbersome to do manually in Excel.

6. Enhanced Collaboration and Access

- Cloud-Based Access: Being cloud-based, Sage Intacct provides easy access to reports from anywhere, promoting collaboration across teams. Finance teams can access and share reports instantly, while Excel files often need to be manually shared and stored in email or file servers, which can lead to version control issues.

- Controlled Permissions: Sage Intacct enables you to set granular permissions, ensuring that only authorised personnel can access certain reports, which improves data security. Excel files, on the other hand, can be easily shared and modified by anyone with access to them.

7. Auditability and Compliance

- Audit Trails: Sage Intacct automatically records and maintains a comprehensive audit trail for every transaction, making it easier to comply with regulations and conduct audits. In Excel, tracking changes or understanding the history of edits made to a report can be difficult, particularly if multiple versions are in use.

- Internal Controls: Sage Intacct enhances internal controls by standardizing workflows and report generation, ensuring compliance with accounting standards. Excel’s flexibility can be a disadvantage in this regard, as it allows for inconsistencies in reporting and compliance practices.

8. Integration with Other Business Systems

- Seamless Integration: Sage Intacct integrates with other business systems (e.g., CRM, payroll, ERP), allowing for better cross-functional reporting and minimizing the need to manually transfer data between systems, which is common in Excel-based workflows.

- Unified Data: By consolidating all business data into one platform, Sage Intacct ensures that reports are based on accurate and unified data, eliminating the risk of errors caused by disparate systems and manual data entry.

9. Support for Multi-Dimensional Reporting

- Dimensions-Based Reporting: Sage Intacct allows for multi-dimensional reporting (e.g., tracking expenses by department, project, region, etc.), which is much more flexible and dynamic than Excel. With Excel, such reporting often requires complex formulas or multiple pivot tables, which can be time-consuming and error-prone.

- Easier Comparison: You can easily compare financial performance across various segments, such as regions, departments, or products, with Sage Intacct. Excel would require multiple sheets or manually linking data to generate similar comparisons.

10. Enhanced Decision-Making Capabilities

- Faster, Data-Driven Decisions: Sage Intacct allows finance teams and executives to access real-time reports that support quicker and more informed decision-making. Manual reporting in Excel can delay critical decisions due to the time required for data entry, updates, and analysis.

- Better Resource Allocation: With Sage Intacct’s more sophisticated reporting and analytics tools, businesses can make better decisions on resource allocation, budgeting, and forecasting, rather than relying on static data from spreadsheets.

Conclusion

Using Sage Intacct for reporting instead of Excel and manual tasks provides significant advantages in terms of accuracy, efficiency, scalability, and decision-making. The automated, real-time reporting capabilities of Sage Intacct reduce the time spent on manual tasks, minimize errors, and deliver actionable insights. For growing businesses looking to scale, Sage Intacct’s ability to handle complex, multi-dimensional reporting needs ensures that you can maintain control and visibility over your financial data, helping to optimise operations and drive business success.