As you explore Sage Intacct, one of the first questions you’ll likely have is “how much does it cost?” The simple answer is Intacct isn’t a one-size-fits-all – which is one of its’ greatest strengths! That said, this post explains how Sage Intacct pricing works with Acuity24.

SAGE INTACCT PRICE CHECK

Flexible and Tailored Pricing

Unlike lots of “all-in-one” accounting solutions, Sage Intacct is a modular, highly configurable solution, meaning you only pay for the features and functionality you actually need.

Why Sage Intacct Uses a Flexible Pricing Model:

Every organisation’s accounting and financial management requirements are different. A growing startup has a very different set up and needs than a multi-entity enterprise with complex consolidations, global reporting and multiple currencies.

Sage Intacct Pricing is based on:

- Modules you select: Core financials are standard, but you can add modules such as Accounts Payable Automation, Inventory, Projects, Contracts, or Multi-Entity Consolidation depending on your specific business needs.

- Number of users: Pricing typically scales with the number of named users who need access.

- Product & Services: Acuity24 Sage Intacct Pricing is broken down into a monthly price for the product and a set monthly amount for unlimited services. This provides customers with enhanced support as and when they need it, particularly during the first 24 months post-implementation.

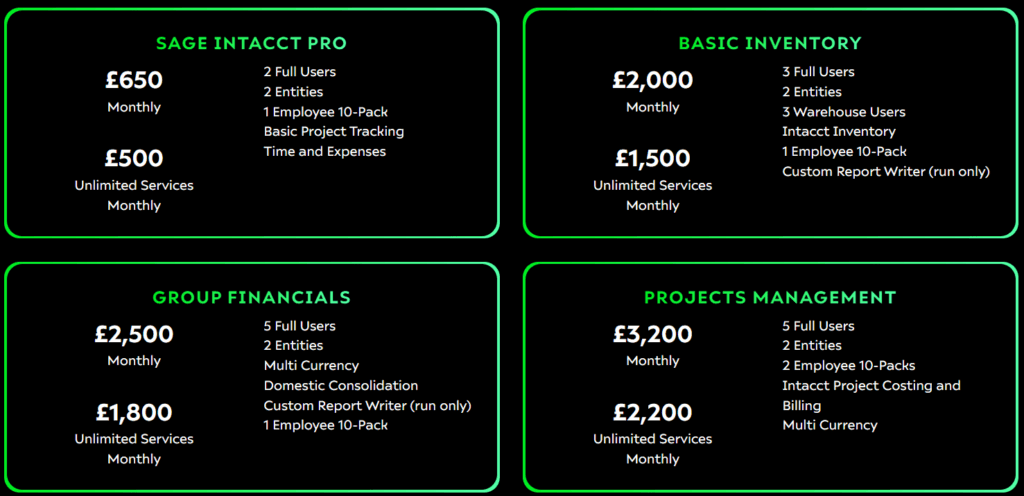

Sage Intacct Pricing with Acuity24*

As outlined in the above image, Acuity24’s Sage Intacct pricing is broken down into product and service costs, starting from £650 monthly for 2 full users and up to 2 entities with basic project tracking with time and expenses, then a fixed amount of £500 for unlimited support.

The pricing then differs depending on more complex needs, for example those needing basic inventory management with up to 3 full users is priced at £2,000 monthly with a £1,500 fixed price for unlimited support.

Group financials with up to 5 users and 2 entities with multi currency requirements is £2,500 monthly plus £1,800 for unlimited support or £3,200 monthly + £2,200 unlimited support to include Sage Intacct Project Costing and Billing.

Take our 2 minute Sage Intacct Price Check Questionnaire here to see how much Sage Intacct could be for your business.

*Pricing shown correct as of September 2025.

WHAT’S INCLUDED IN THE CORE PACKAGE?

As you’d probably expect, Sage Intacct Core Financials covers the essentials most businesses need, which include:

- General Ledger

- Accounts Payable & Receivable

- Cash Management

- Order Entry / Purchasing

You can then build on this with the addition of modules to match your unique needs — making Sage Intacct a solution that grows with you. Acuity24 work in close partnership with customers, ensuring we fully understand your business needs and goals from the outset. Our team of experts are on hand to provide tailored demonstrations of modules and advice, making sure your Sage Intacct customisation matches present and future requirements.

CASE STUDIES

ADDITIONAL SAGE INTACCT MODULES AND EXTENSIONS

Popular Sage Intacct modules include:

- Multi-Entity & Global Consolidations – for businesses with multiple subsidiaries or international operations

- Project Accounting – for service-based businesses tracking project profitability

- Contracts & Subscription Billing – for SaaS and recurring revenue models

- Inventory Management – for product-based businesses

Because you can add or remove modules as your business evolves, you maintain cost control and avoid paying for features you don’t use.

In addition to the Sage Marketplace, the Acuity24 Marketplace features custom-built add-ons for Sage Intacct and Sage X3, including:

- Sales and Purchase Fast Entry– streamlines creation, payment and processing of invoices and payments/

- Bank Reconciliation Custom Module– automates bank reconciliations, seamlessly matching transactions with your ledger in real-time, eliminating manual data entry and reducing error-risk.

- Fixer Exchange Rates– a solution that regularly updates foreign exchange rates, ensuring accurate and timely currency conversion across transactions, including Crypto currencies.

GET IN TOUCH

Arrange an introductory call with one of our Sage Intacct experts who can:

- Assess your needs

- Recommend the right modules

- Provide a custom quote based on users, configuration, and support requirements