Sage Intacct’s latest release of 2025 is here! The automatic update hit your screens on August 8th 2025 with even more new features and updates to make the most of!

You may have seen the announcement on your Sage Intacct homepage, these are our top highlights!

- Streamline Customer Refunds

The new Customer refunds functionality lets you record refunds issued outside Sage Intacct and automatically clear the associated credits. Use customer refunds to resolve credit balances when a customer does not intend to make future purchases or requests a refund due to a dispute.

In Intacct, a customer refund is record of payment that you’ve already made to a customer.

When you record a refund, Sage Intacct provides a list of available credits for the customer,

based on the selected currency. You match the credits to the refund and adjust the refunded amount for each credit as needed.

When you post the refund, Sage Intacct automatically clears the selected credits, ensuring the customer’s account remains up to date. Since customer refunds reflect transactions that

occurred outside of Sage Intacct, the payment method is always Record transfer.

Get started with configuring refunds here.

- New and Improved Lists for Increased Flexibility

Sage Intacct list views are changing and the new list view experience is being rolled out in phases and will become the default. You can still switch back to the old version if you prefer.

The new list views give you the flexibility to:

- Add, move and resize columns

- Freeze columns on the page to preserve the view when scrolling

- Sort columns by the data that means the most to you

- Save your customized views for future use

- Refine your results with advanced filters

- View record details next to your list

- Complete bulk operations

- Set a Delegate Approver for AP Invoice Approvals

The new enhancements means that you now have better control when an approver is out of office, ensuring that invoices continue to move through the approval workflow without delay.

To use this an administrator enables delegation and selects delegates in the AP purchase invoice approval settings section of Configure Accounts Payable.

When an individual approver is going to be out of office, the approver turns on delegation in their preferences and specifies the time period when they’ll be away.

During the out-of-office time period, new AP purchase invoice submissions are routed to the delegate for review. The delegation ends automatically when the out-of-office period expires. After that point, newly submitted AP purchase invoices are routed to the original approver.

See here for further details and how to setup your delegates: Delegate AP purchase invoice approvals when an approver is out of office.

- More ways to pay your AP invoices

Avoid interrupting your workflow by paying suppliers directly from the suppliers list.

The Pay option now appears for each supplier in the Suppliers list when you have the appropriate permissions to pay AP purchase invoices. When you select Pay for a supplier, a Pay AP purchase invoices window appears, showing the supplier’s open AP purchase invoices.

- The Pay option appears for all suppliers, regardless of their state or total due.

- Pay is available at both the top level and entity level.

- There are some conditions when AP purchase invoices cannot be paid from the Suppliers list and must be paid from Pay AP purchase invoices, instead. The Help Centre provides more information about these conditions.

See here for further details Pay AP purchase invoices from the Suppliers list

- Add the payment approval details to your custom reports

Get better visibility of who approved a payment in your reporting outputs. You can now add the payment approval details to your custom reports by selecting AP Payment Approval History as your primary data source when creating a report.

For details about available objects for Accounts Payable custom reports, see the object glossary.

- More ways to receive customer payments

You can now select to receive customer payments whilst on the customer list, minimising impact to your workflow.

By using the Apply payment option for each customer when in the customer list, a “receive payments” window will pop up showing the customers open AR Invoices.

- The Apply Payment option appears for all customers, regardless of their state or total due.

- Apply Payment is available at both the top level and entity level.

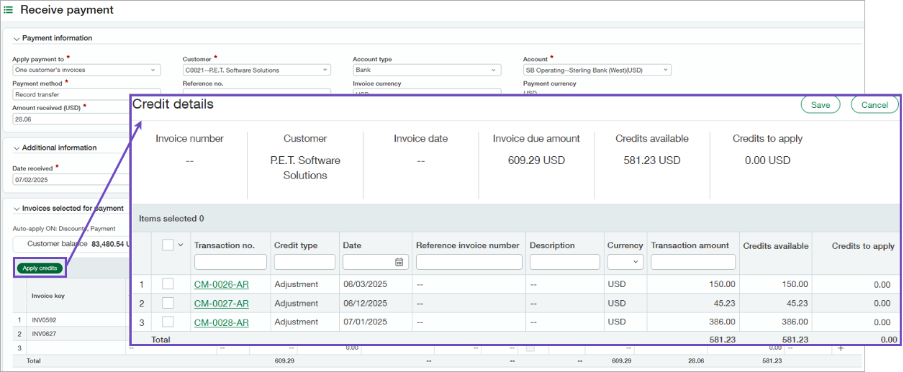

- Streamline how you apply credits when receiving a payment

Reduce clicks, simplify workflows, and improve overall usability when applying credits in AR.

You can now:

- Apply a credit to multiple AR sales invoices in a single payment, eliminating the need to post separate transactions for each AR sales invoice.

- Forego the math and let Sage Intacct determine how to apply credits across multiple AR sales invoices, using the waterfall method.

- Stay efficient while working from the Advances or AR adjustments list, where you can now receive a payment at the same time that you apply credits.

- Easily apply a credit that exceeds the value of a single AR sales invoice, as long as multiple AR sales invoices are selected.

Select the Apply Credits button to Receive payments. You can use it to select credits that you want Intacct to distribute across your selected AR sales invoices, using the waterfall method.

Find out more on the various scenarios here.

- Improvements to the customer advances

Sage Intacct have included enhancements to the customer advances, making it easier for you save advances as draft where not all information is currently available and track, search and report on payment ID’s making reconciliation quicker and easier.

See here for further details Enhancements to customer advances.

- Import bill back transactions in large volumes

Eliminate repetitive data entry by importing large volumes of bill back AR invoices at once by using the new AR CSV template. Add the ID of the bill back template to the new column and let Intacct create the corresponding AP purchase invoice upon import.

In the new BILL_BACK_TEMPLATE column of the CSV template, provide the bill back template ID that you want to use for the AR sales invoice. Before you import bill back AR sales invoices, the following must be true:

- The template IDs that you provide must already be set up as Bill back templates.

- The customers you are invoicing must also be set up for bill back before you import the bill back AR sales invoices

Remember to import AR sales invoices for bill back at the top level only.

- Funds transfers at entity level now require at least one bank account from that entity

When you add a funds transfer at the entity level, Intacct now checks that at least one of the accounts is owned by the entity. If neither account belongs to the entity, Intacct displays a message to inform you and does not post the transaction.

At the entity level, go to Cash Management > All and select Add (circle) next to Funds transfers. Select the two cash accounts for the transfer:

- From account: The source account.

- To account: The receiving account.

At least one of the selected accounts must belong to the entity. If neither account is at entity level, an error appears and the transfer is not posted.

- Enhanced reporting for group tax solutions – UK ONLY

Sage Intacct have added an additional VAT report to support group VAT filing.

UK tax submission box detail report VAT group: This report displays information in the submission box detail report. It also displays location and location ID information for all entities that share a tax ID to facilitate group VAT filing.

See here for further details and how to download the UK Tax Submission Box Detail Report – New and updated custom reports for standard tax solutions.

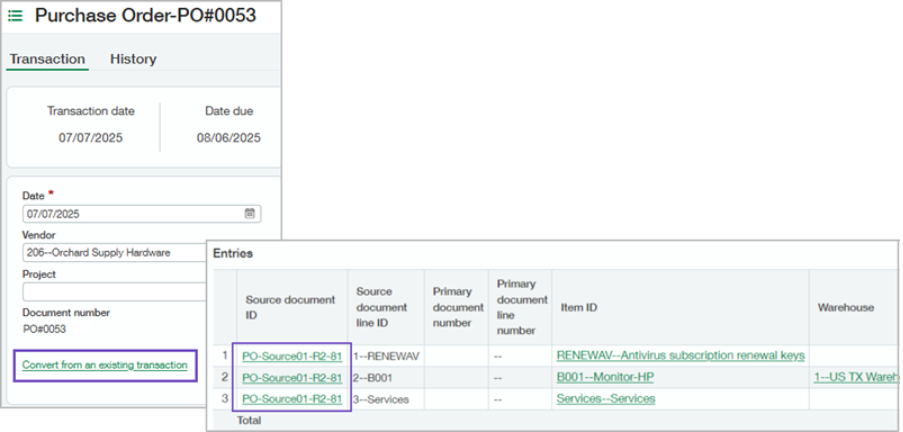

- Save time and convert multiple purchasing transactions in one go

Previously you could only convert one purchase transaction at a time, by selecting the purchase order and selecting convert. Now save time by converting multiple purchasing transactions in one go.

For example, when a supplier sends you an invoice for multiple orders, you can create a single Purchasing transaction from multiple converted documents, including specific line items.

For more information on enabling and converting multiple purchasing transactions click here: A new way to combine multiple documents into a single transaction—General availability.

COMING SOON

Line-level matching for smarter Purchasing automation—Early Adopter

Line-level matching introduces a more precise way to automate transaction processing with AP Automation with Purchasing. Instead of relying on source transaction data, this feature uses AI/ML to match and populate line items directly from supplier documents that you email or upload. This enhancement helps reduce manual corrections and improves automated transaction draft accuracy.

Line-level matching increases the accuracy of transaction data by using the supplier document as the source of truth. It flags discrepancies in quantity or price, allowing you to quickly identify and resolve mismatches. This reduces the time spent on manual edits and improves confidence in automated transaction processing.

What’s the Early Adopter program?

The Early Adopter program allows a select group of customers to test and provide feedback on new features. Your input will help us refine and improve these features before the general release.

If you want to be considered for the Early Adopter program, complete this form today.

No more spoilers!

The above are a few of our favourite changes in the latest release. More details can be found on all of these plus more when you login to your Sage Intacct homepage, Alternatively, you can find further information by joining us at our Learning Lab on Thursday 28th August @12pm. Register here or click here to read more about Release 3 2025.

Should you want to discuss any of the changes or have any question please feel free to send us a message at customersuccess@acuitysolutions.co.uk or call us on 01932 237110 .