Both are popular platforms in the financial management world but how do you choose whether Sage Intacct vs Quickbooks is right for your business? In this post we explore the differences and benefits of both options and whether quickbooks or sage intacct suits your needs best:

Sage Intacct vs QuickBooks

Easy to use, affordable, and well-suited for startups and small businesses with simple structures, QuickBooks is a popular bookkeeping platform enabling users to keep track of transactions and maintain their books. However, functionality gaps are clear in terms of automation, analysis and reporting as your business grows. Adding entities and entering new regions demand a more comprehensive solution and deeper insights into performance, which isn’t one of QuickBooks’ strengths.

Sage Intacct is a cloud accounting solution designed for growing businesses. Intacct’s modular design allows for customisation, simplifying management of both core accounting and more complex financial management needs including multi entity, multi-currency and inter-company transactions. Customisable dashboards and real-time reporting provide essential insights on demand,, promoting more informed and faster decision-making when it matters most.

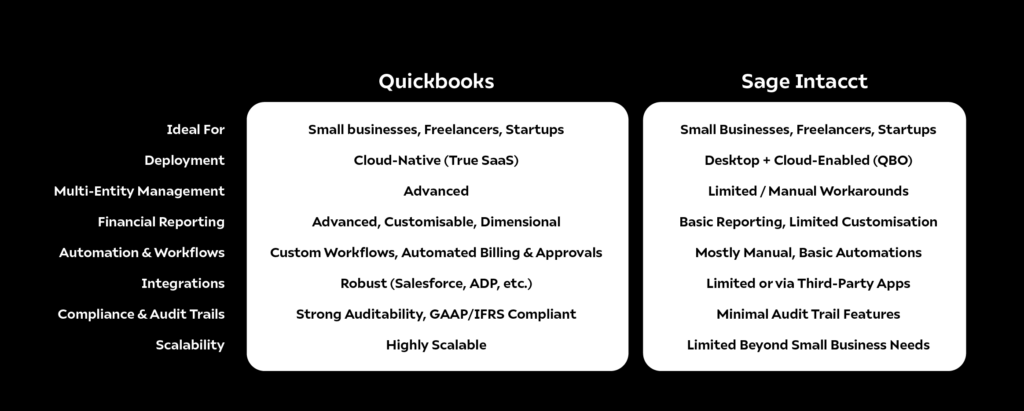

Sage Intacct vs QuickBooks Overview

How do you decide between QuickBooks or Sage?

Choosing the right solution comes down to your current situation, your budget and your future plans for the business. As a startup for example, QuickBooks might be a great option but if you plan to expand your business, more advanced tools and access to data will support your growth.

Here are some of the main reasons growing businesses choose to upgrade from QuickBooks to Sage Intacct:

1. MULTI-ENTITY MANAGEMENT AND SCALABILITY

QuickBooks is great for businesses with simple structures and basic accounting needs. But introducing multiple entities, global operations, or intercompany transactions into the mix, workloads significantly increase as each entity is managed separately with no group reporting functionality.

Sage Intacct is designed to handle multi-entity, multi-currency, and multi-location environments seamlessly. Intacct enables you to consolidate financials in real-time, automate intercompany eliminations, and maintain compliance across jurisdictions—all without clunky workarounds.

| Multi-Entity Problem | QuickBooks Limitation |

|---|---|

| Managing multiple legal entities | Must use separate company files |

| Intercompany transactions | Manual, not automated |

| Consolidated reporting | Not supported natively |

| Shared chart of accounts | Not possible across separate files |

| User access & permissions | Not centralised |

Summary:

Businesses growing into multiple subsidiaries or operating internationally need tools that scale with them. QuickBooks often requires third-party apps or manual spreadsheets. Sage Intacct does it natively.

2. TRUE CLOUD ARCHITECTURE

While QuickBooks Online exists, it’s essentially a cloud-enabled version of desktop software. Sage Intacct, on the other hand, is a true cloud-native solution, built from the ground up for the web.

This translates into:

- More reliable performance

- Real-time access from anywhere

- Automatic updates with no downtime

- Greater integration flexibility

| Feature | Sage Intacct | QuickBooks |

|---|

| Cloud-Native Design | ✅ Yes – Built from the ground up for the cloud | 🚫 No – Desktop roots, cloud add-on (QBO) |

| Real-Time Access Anywhere | ✅ Full browser-based, secure, mobile-friendly | ✅ Online version supports remote access |

| Automatic Updates | ✅ Seamless, behind-the-scenes automatic updates | ⚠️ Manual updates for desktop; auto for QBO |

| Custom Dashboards & KPIs | ✅ Role-based, real-time visual dashboards | ⚠️ Limited customisation |

| Multi-User Collaboration | ✅ Granular user roles, audit trails, team-ready | ⚠️ Basic access levels, less scalable |

| API & Integration Ecosystem | ✅ Robust open API, deep integrations (e.g., Salesforce) | ⚠️ Limited integrations or requires third-party tools |

| Data Security & Compliance | ✅ SOC 1 & SOC 2 certified, enterprise-grade | ⚠️ Good for small business; weaker for audit/control |

Summary:

Modern finance teams are often distributed. You need a system that supports secure, real-time access and collaborative workflows.

3. ADVANCED REPORTING AND INSIGHTS

QuickBooks delivers basic financial statements and reporting. But for companies in need of departmental tracking, dimensional analysis, custom dashboards, or audit trails, it falls short of requirements.

Sage Intacct’s powerful reporting capabilities allow you to:

- Track performance by project, location, customer, or product line

- Create real-time dashboards for different roles

- Easily comply with GAAP, IFRS, and industry-specific standards

| Reporting Feature | Sage Intacct | QuickBooks |

|---|

| Real-Time Reporting | ✅ Yes – Instant, live data | ⚠️ Limited – Some reports delayed or manual |

| Custom Reports & Dashboards | ✅ Highly customisable, user-specific views | ⚠️ Basic templates, limited custom options |

| Multi-Dimensional Reporting | ✅ Yes – Tag by location, project, department | ❌ Not supported |

| Consolidated Reporting (Multi-Entity) | ✅ Native, real-time consolidations | ❌ Manual via Excel or add-ons |

| Drill-Down Capability | ✅ Full drill-down to transaction level | ⚠️ Partial or limited |

| Scheduled & Automated Reports | ✅ Schedule, automate, and distribute easily | ⚠️ Manual or requires third-party apps |

| Compliance-Ready Reporting | ✅ GAAP/IFRS compliant, audit-ready | ⚠️ Basic financial reports, not built for audit |

Summary:

Growing businesses need insight, not just numbers. Intacct helps CFOs make faster, data-driven decisions.

4. IMPROVED EFFICIENCY AND AUTOMATION

Performing repetitive manual tasks like reconciling data, entering journal entries, or managing approvals through email are the norm for QuickBooks users.

Sage Intacct offers:

- Automated billing, revenue recognition, and approvals

- Custom workflows for purchase orders, expenses, and more

- Seamless integrations with Salesforce, ADP, and other platforms

Summary:

Automation saves time and reduces human error. With Sage Intacct, your finance team can focus on strategy, not spreadsheets.

5. AUDITABILITY AND COMPLIANCE

Sage Intacct is AICPA-endorsed and offers robust audit trails, user permissions, and compliance features out of the box.

QuickBooks lacks many of these controls, making it harder to meet audit and regulatory standards as your business expands.

DISCOVER SAGE INTACCT FOR YOUR BUSINESS:

QuickBooks is an excellent tool—until it isn’t. If your business is scaling fast, managing complexity, or striving for deeper financial control, it’s time to consider Sage Intacct. It’s not just a software upgrade; it’s a strategic investment in financial clarity, efficiency, and growth.

Get in touch to arrange an initial call back or 1-2-1 Sage Intacct Demo: