Selecting the right finance and accounting platform is crucial for UK businesses aiming to streamline operations, improve financial visibility, and support future growth. Two of Sage’s leading solutions, Sage Intacct and Sage 200, are popular choices, but they serve different needs and company profiles.

In this blog, we’ll unpack how these platforms compare across functionality, scalability, deployment, reporting, and business impact, helping you decide which one aligns best with your goals.

SAGE INTACCT VS SAGE 200 COMPARISON GUIDE

Overview: Sage Intacct and Sage 200

Sage 200 is a long-established mid-market ERP accounting product widely used in the UK. It supports core accounting, reporting, inventory, project tracking, and multi-departmental finance management.

Sage Intacct is a modern, cloud-native financial management solution designed for automation, real-time insights, multi-entity complexity, and scalable growth. While both serve finance needs, they differ significantly in capabilities and architecture.

1. Architecture & Deployment

Sage 200

- Traditionally on-premises or hosted via third-party providers

- Requires dedicated IT support, backups, and infrastructure

- Updates can be manual and less frequent

Sage Intacct

- Cloud-native SaaS platform with regular automatic updates

- Accessible anywhere via browser with enterprise-grade security

- Zero infrastructure burden for customers

Bottom Line:

Cloud-native architecture gives Sage Intacct a significant edge for businesses wanting flexibility, remote access, and automatic compliance updates.

2. Financial Management & Core Accounting

Sage 200

- Strong core financial capabilities for small-to-medium UK businesses

- Handles general ledger, payables, receivables, nominal coding, and reporting

- Good for basic multi-department accounts

Sage Intacct

- Advanced core financial engine with multi-dimensional reporting

- Real-time dashboards and analytics

- Automated journal entries and allocations

- Strong audit trails and built-in controls

Bottom Line:

Both systems cover core accounting, but Sage Intacct delivers more automation, real-time insights, and deeper financial controls without heavy manual reconciliation.

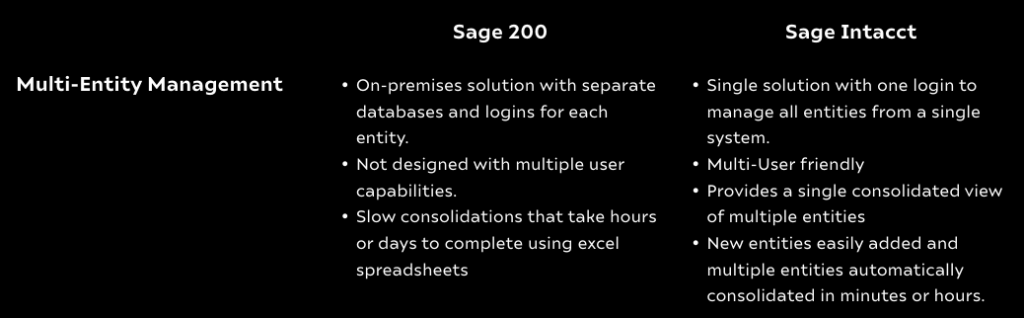

3. Multi-Entity & Global Operations

While Sage 200 supports multi-company environments, it often requires manual consolidation unlike Intacct’s automated consolidation capabilities.

Ideal for businesses expanding internationally or managing multiple legal entities, Sage Intacct supports native intercompany elimination, multi-currency and cross-entity reporting with less complexity than Sage 200.

Bottom Line:

If your organisation has multiple companies, subsidiaries, or currencies, Sage Intacct vastly reduces manual effort and error risk.

4. Reporting & Analytics

Sage 200

- Traditional financial reports via built-in tools

- Often relies on exports to Excel for bespoke analysis

Sage Intacct

- Interactive real-time dashboards

- Multi-dimensional reporting without spreadsheets

- Drill-down capability directly from dashboards

- Embedded analytics support scenario modelling

Bottom Line:

Intacct’s reporting is richer, faster, and built for strategic finance leadership, giving teams up-to-the-minute clarity for decisions. Explore Sage Intacct’s advanced and highly customisable reporting in more detail: Read More Here.

5. Automation & Workflow

Sage 200

- Manual workflows are common for invoice approvals, allocations, and consolidations

- Limited automated journal entries

Sage Intacct

- Automates routine processes like invoicing, approvals, allocations, and recurring entries

- Supports continuous close and configurable approval workflows

- Reduces manual tasks and improves accuracy

Bottom Line:

Automation in Sage Intacct accelerates month-end close, reduces errors, and frees finance resources for strategic work.

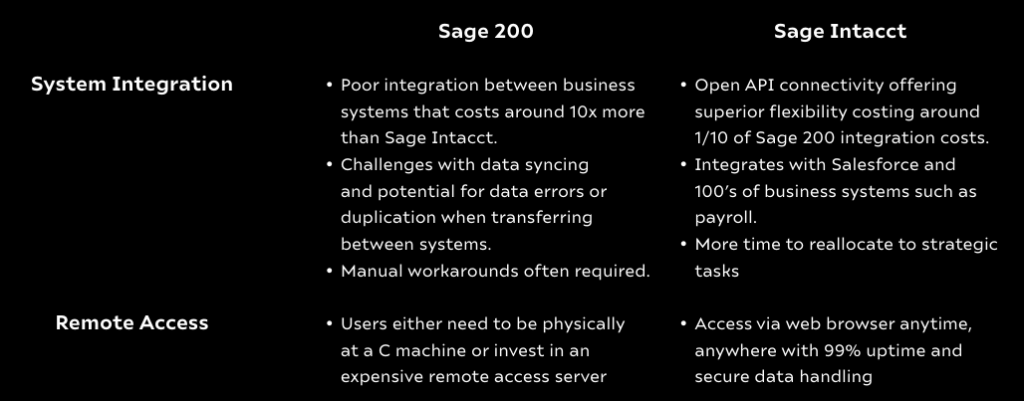

6. Integration & Extensibility

Sage 200 integrates with various third-party systems (CRM, payroll, etc) usually requiring custom development, whereas Sage Intacct features open API connectivity and is easily integrated with platforms including Salesforce CRM. Designed to be part of a wider cloud ecosystem, Sage Intacct scales with your business.

View our Marketplace of custom built extensions for Sage Intacct: View Marketplace Here.

7. Compliance & Security

Sage 200

- Security and compliance depend on hosting and internal IT practices

- Updates may be reliant on IT schedules

Sage Intacct

- Enterprise-grade cloud security with automatic patches

- Built-in audit trails and internal control features

- Easier compliance with external regulations

Bottom Line:

Sage Intacct’s cloud security and automated compliance are significant advantages for organisations concerned about data protection and audit readiness.

8. Which Suits Your Business Best?

Business Requirements of Sage 200 Users:

- You’re a UK-based SME with simpler accounting needs

- You prefer traditional deployment or have existing Sage 200 expertise

- Multi-entity reporting isn’t a priority

- You have limited need for advanced automation or real-time analytics

Business Requirements of Sage Intacct Users:

- You plan to scale or have multi-entity operations

- You require automated workflows and real-time financial insights

- You want a cloud-native platform with strong global capabilities

- Your finance team needs strategic reporting and deeper analytics

- You want to reduce IT burden and support remote work

Working with Acuity24 as your Sage Intacct Partner

We’ve used our decades of Sage solutions expertise to help customers migrate to Sage Intacct and Sage X3 with the support of our talented, dedicated team. We also offer:

- Flexible payment options (including Direct Debit and milestone billing).

- Fixed price services (no additional costs even if the project runs over).

- Free training and resources helping you get the most out of your investment.

See what our customers say, arrange a demo or call or take our 2 minute price check below: