Sage Intacct’s Fourth and Final release of the year is here!

The automatic update hit’s your screens on November 8th 2024 with even more new features and updates to make the most of!

You may have already seen the announcement on your Sage Intacct homepage, where you can read more, in addition to our highlights below.

Our Top Highlights of Sage Intacct R4 Release, November 2024

Note: Some permissions have been added and changed to support the new features. New Permissions are automatically “OFF” by default and will need switching “ON” by you to use the features. New Permissions include: AP/Supplier Reconciliation – Run – Allows you to run the supplier reconciliation report. AR/Customer Reconciliation – Run – Allows you to run the customer reconciliation. T&E – Electronic receipts: List, View, Edit, Delete, Upload, Manage staff electronic receipts ns in this release which require action to update user/role permissions.

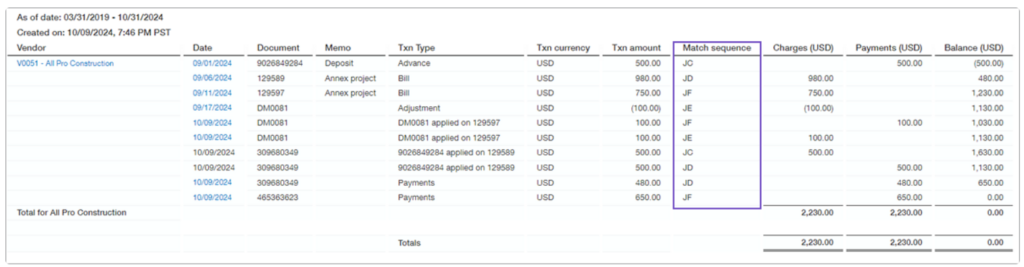

- Reports to reconcile AP invoices to supplier payments and credits more easily

Easily match your credits and payments to AP purchase invoices using the Supplier reconciliation report. At a glance, you can see not only how much you owe a supplier, but also how payments and credits were matched to AP purchase invoices.

How it works:

Set Up:

- Some set up steps are required to enable the match sequences and the supplier reconciliation. There are 3 set up steps required, follow the links below to see further details on enabling this functionality.

Once the set-up is complete, users with permissions can start making use of the reconciliation report.

To run the Supplier reconciliation report:

- Go to Accounts Payable > All > Reports > Supplier reconciliation.

- Select a reporting period.

- Choose the suppliers that you want to include in the report.

a. If you want to restrict the report to a single supplier, set the From supplier and To supplier to the supplier name.

b. Select the Include all suppliers checkbox to include transactions from suppliers with zero balances.

c. Select Include Zero balance suppliers with activity to include accounts with zero balances only if these suppliers had activity during the selected time period.

- If you want to examine the reconciliation for a particular match sequence only, enter it into Match sequence.

- To view only the transactions that are not fully reconciled, select the following

a. Under Matches to display, choose Select.

b. Select Unmatched and Partially matched.

c. Select Done.

- Set the Sort by order.

In addition to sorting by supplier or AP purchase invoice, you can also sort by match sequence.

- Set any other filters that you need, such as Location or Currency.

- Select View.

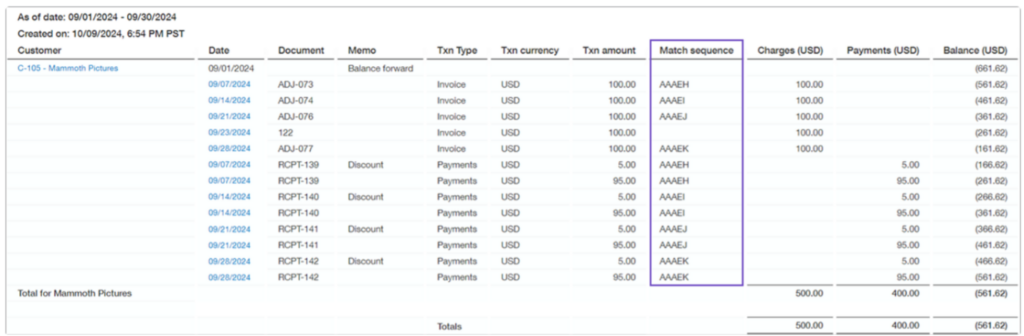

- Reconcile customer payments and credits to AR sales invoices with reports.

Similarly to reconciling suppliers above, this release also includes the ability to easily see how payments and applied credits match to AR sales invoices using the Customer reconciliation report. Again giving users visibility on how much a customer owes, but also how payments and credits were matched to AR sales invoices.

The Customer reconciliation report answers the following types of questions:

- Which credits and payments were applied to a given AR sales invoice?

- Where was a given credit applied?

- Which transactions share a specified match sequence?

What transactions remain partially matched or not matched at all?

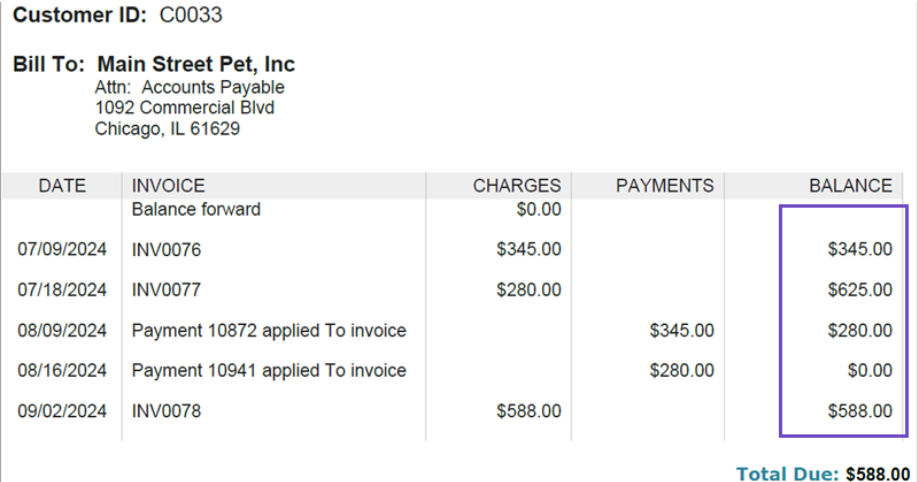

- Enhancements to Accounts Receivable statements

Improve your customer experience by removing the need for customers to perform manual calculations by adding a running balance to your custom statement templates.

Currency symbols now display alongside amounts by default, adding clarity to foreign-currency statements.

Add a running balance to your existing custom templates using the merge field <<PRENTRY_BALANCE>>.

The running balance for Accounts Receivable statements is supported in printed document templates only.

Standard statement templates (those with a document owner of Intacct) do not include running balances.

Generate statements using the updated template

- Go to Accounts Receivable > All > Invoices > Print or email > Statements.

- Set the time period and filters as you want them.

- For Printed document template, select the name of the custom template you updated.

- Select View.

- Adjust the selections in the Print column as needed.

- Select Print or email to generate the PDFs.

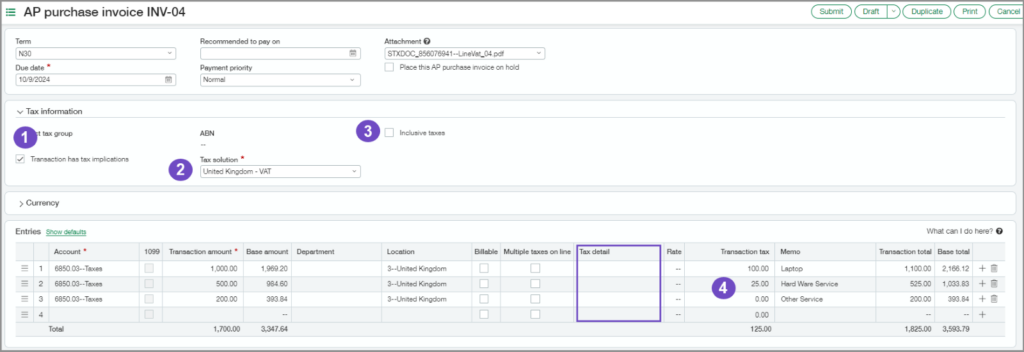

- Expanded support of AP Automation for companies using the Taxes application.

The new AP Automation function now populates tax information for companies that use the Taxes application. This means that less manual data entry is needed before posting in order to capture the transaction tax.

AP Automation, an add-on feature to Accounts Payable, streamlines your data entry process to save you time and money. Intacct automatically creates draft AP purchase invoices from AP purchase invoice documents that you email or upload to Sage Intacct. AP purchase invoice details are automatically populated for you, using data from the original document and the supplier information record.

When you upload or email an AP purchase invoice and the predicted location is a taxable location, AI determines the header-level tax information for the transaction.

Tax-related fields are populated in the following way:

- The Transaction has tax implications option is selected when the predicted location has an assigned tax solution.

- Tax solution is derived from the predicted location.

- The Inclusive tax option is selected when the previous AP purchase invoice for the supplier had inclusive tax.

- Line entries display the Transaction tax when the original document has tax information for each line.

When you review the automated transactions, verify the line entries and tax information, then select the Tax details for each line before you post.

- Send automatic payment notifications to more recipients

You are no longer limited on the number of recipients that receive a notification when a payment has been sent. Now, when you make a simple configuration change, Sage Intacct sends automatic notifications to the secondary email address, as well.

- If the Pay-to contact is set to Same as supplier, Intacct uses the Primary and Secondary email addresses for the supplier primary contact, shown on the Supplier tab.

- If there’s no secondary email address defined for the contact, Intacct sends a payment notification to the first email address only. This does not generate an error.

- Payment notification emails that you send when viewing a posted payment are sent to the primary email address only.

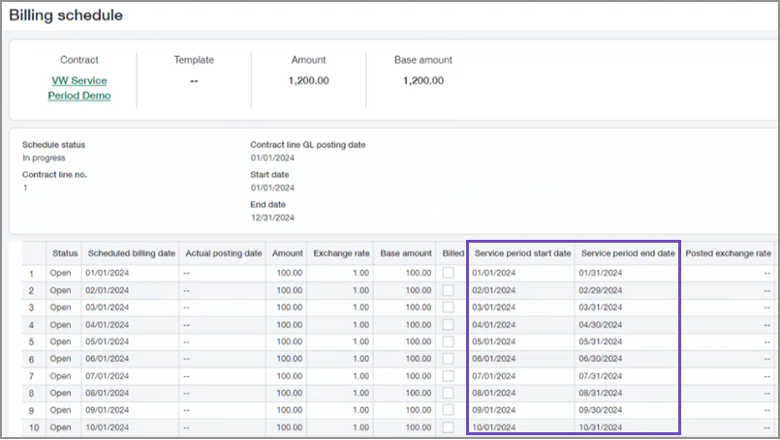

- Add service periods to your contracts

The latest update to the contracts module now enables you to add service periods to your contracts with standard functionality.

Service period dates now automatically populate and seamlessly flow from contracts to invoice generation. This means that customers can see exactly what period they’re being billed for.

Two new fields are now available on contract billing schedule entries and contract usage entries: Service period start date and Service period end date. These fields automatically populate with default values based on the information provided in contract line and usage records. You can edit the dates throughout the workflow for added flexibility.

Existing contract lines and usage records will not have the default service period date fields populated, however you can easily add missing dates during invoice generation.

You can view and edit service period dates at multiple stages of your workflow and set up printed invoices to display them.

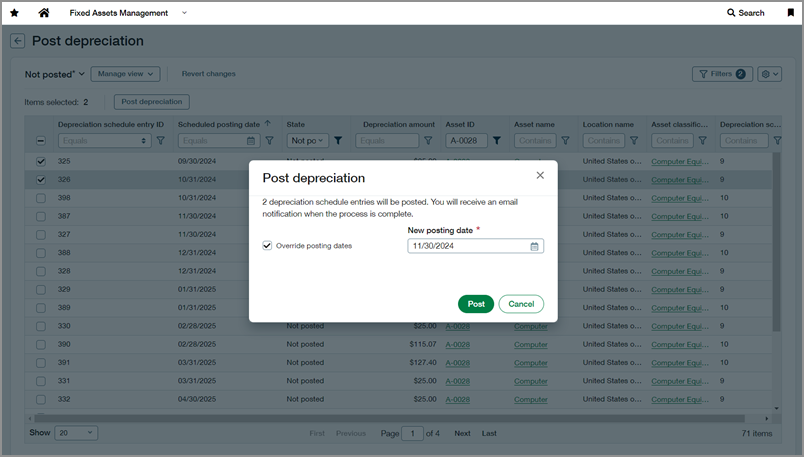

- Override posting dates for Fixed Assets

For those using Sage Fixed Asset Management, you now have the option to choose a custom posting date when posting entries from the Post Depreciation page. The new date overrides the scheduled posting dates.

This feature is particularly useful if entries were originally scheduled for a closed period but you need to post them in an open period. Previously, posting entries from closed periods required reopening and closing the books, which can be an inconvenient process.

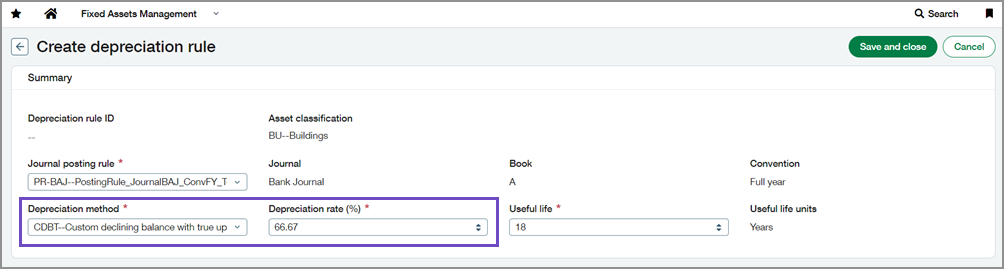

- Customise depreciation methods

A further update to the Fixed Asset Management module is the addition of two new depreciation methods. You can now comply with financial and tax regulations across various regions:

- Custom declining balance with true-up (CDBT)

- Custom declining balance without true-up (CDB)

These methods allow you to customise the depreciation rate applied to assets under a declining balance method, providing greater flexibility in managing your assets.

Coming Soon!

Sage also have some exciting new features currently in their Early Adoption and Beta phases that will move to general availability in a future release. These include:

Tax submissions for custom tax solutions

This feature will streamline the tax filing process for any company using a custom tax solution. When you create a tax submission, you can track transactions that are included for a selected period and then run reports to extract the data needed for filing. After you complete your manual submission, you can mark the submitted transactions as filed.

Pay AP purchase invoices enhancements—Early adopter

Looking for higher capacity AP purchase invoice processing, easier ways to drill down to credits, and the ability to sort and filter columns? This is the early adopter programme for you

These enhancements are useful if you do any of the following:

- Regularly process over 1000 AP purchase invoices to a single supplier and merge payments in the Outbox to combine them

- Selectively apply supplier credits to payments, searching through many available credits

- Want to refine the list of AP purchase invoices to pay on the fly

Enhancements to AP Automation with Purchasing—Early adopter

Get the most out of your AI solutions. Let Sage Intacct create draft PO purchase invoices for you and match them to existing Purchasing transactions with automated Purchasing transactions and document matching.

Sage are continuing the Early adopter program for AP Automation with Purchasing, an add-on to AP AP purchase invoice Automation.

Note: If you are interested in joining any early adopter programmes, please speak to Customer Success to get involved.

No more spoilers!

Should you want to discuss any of the changes or have any question please feel free to send us a message at customersuccess@acuitys24.com or call us on 01932 237110.

Go to our resources library

See our new Sage Intacct content and free training videos, so you can get the most from your solution.